With the rise of privacy-conscious crypto users, the demand for ways to withdraw cash anonymously is at an all-time high. No-KYC crypto credit cards are often touted as a solution, promising anonymity and freedom from intrusive identity checks. But how realistic is it to use these cards for anonymous ATM withdrawals in 2025? Let’s break down the current landscape, bust some myths, and help you make informed decisions about your privacy and financial safety.

No-KYC Crypto Cards: What Do They Really Offer?

No-KYC (No Know Your Customer) crypto cards are designed to let users spend their digital assets without undergoing traditional identity verification. This appeals to those who value privacy or are wary of sharing personal data with centralized platforms. Services like No KYC Cards, FirstCryptoCard, and CryptoCardInsta have made it possible to use crypto for online shopping or in-store purchases via Apple Pay or Google Pay integration.

However, there’s a crucial limitation: most no-KYC crypto cards are virtual-only. This means they’re great for digital transactions but not for withdrawing physical cash from ATMs. Even platforms that market themselves as privacy-first rarely support anonymous ATM withdrawals due to financial regulations and card network restrictions. For example, FirstCryptoCard and CryptoCardInsta both focus on virtual spending but do not allow cash withdrawals at ATMs (source, source).

The Reality of Anonymous Cash Withdrawals

If you’re hoping to walk up to an ATM and withdraw fiat currency anonymously using a no-KYC crypto card in 2025, the reality is stark: it’s nearly impossible with reputable providers. Here’s why:

Top 5 Reasons No-KYC Crypto Cards Can’t Enable Anonymous ATM Withdrawals

-

Most no-KYC crypto cards are virtual-only—Platforms like No KYC Cards and FirstCryptoCard issue virtual cards designed for online and in-store mobile payments, not for ATM cash withdrawals.

-

ATM withdrawals require physical cards and banking network access—Virtual no-KYC cards lack the physical chip or magnetic stripe needed for ATM use, and issuers rarely provide plastic cards without identity verification.

-

Regulatory scrutiny and anti-money laundering (AML) laws—Even if a no-KYC card supports ATM withdrawals, large or suspicious cash transactions can trigger regulatory action, risking frozen or seized funds per OneKey.

-

Frequent service disruptions and program shutdowns—No-KYC card issuers operate in a legally gray area; platforms like CryptoCardInsta warn that offerings can be suspended or altered without notice, potentially locking users out of their funds.

-

Cash withdrawals undermine the anonymity of crypto—Withdrawing cash from an ATM often leaves a trail (camera footage, ATM logs, etc.), which can compromise privacy even if the card itself doesn’t require KYC.

Even if you find a provider claiming to offer this feature, proceed with extreme caution. Many such services operate in legal gray zones or offshore jurisdictions. Regulatory crackdowns can lead to frozen funds or service shutdowns overnight (learn more about regulatory risks here). If large sums start moving through these cards and are traced back to residents in regulated countries, authorities may seize your funds under anti-money laundering rules.

What Can You Really Do With No-KYC Crypto Cards?

The most practical use case for no-KYC crypto debit or credit cards right now is spending your assets online or in-store without revealing your identity. Here’s how most users leverage these tools:

- Online Shopping: Use virtual cards at e-commerce sites that accept Visa/Mastercard.

- Contactless Payments: Add your card to Apple Pay or Google Pay for tap-to-pay convenience at retail stores.

- Pseudonymous Spending: Maintain a layer of separation between your real-world identity and spending habits.

If your goal is true anonymity while accessing fiat cash, you’ll need alternative strategies outside mainstream no-KYC card offerings, often involving decentralized peer-to-peer exchanges or trusted OTC partners. But remember: every step toward greater anonymity also increases risk exposure if you aren’t careful.

It’s vital to recognize that the promise of anonymous crypto ATM withdrawal remains, in practice, out of reach for most privacy-focused users. The technical and regulatory hurdles are simply too high for mainstream, reputable no-KYC card providers to overcome. Services like No KYC Cards and FirstCryptoCard have chosen compliance and longevity over risky features, prioritizing user security even if it means sacrificing cash withdrawal capabilities.

Safer Alternatives for Privacy-Minded Users

If you’re determined to withdraw cash anonymously, consider these realistic alternatives, each with its own trade-offs between privacy, convenience, and risk:

Top Ways to Withdraw Crypto as Cash Privately (2025)

-

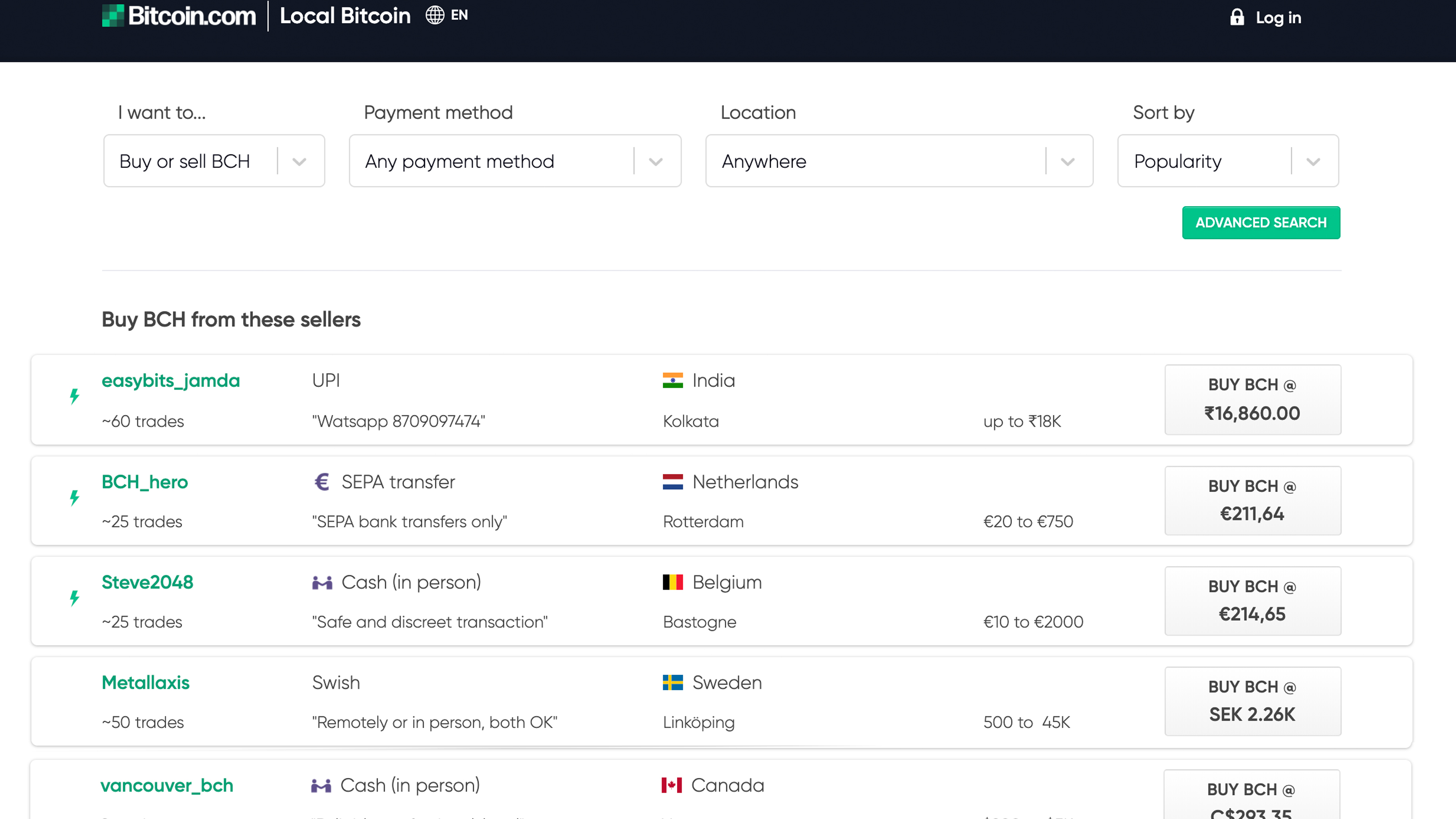

Peer-to-Peer (P2P) Crypto Marketplaces: Platforms like LocalBitcoins and Paxful allow users to sell crypto directly to buyers for cash, often with minimal or no KYC requirements. Always meet in safe, public locations and use platform escrow for security.

-

Bitcoin ATMs with No or Minimal KYC: Some Bitcoin ATMs permit small, anonymous cash withdrawals and deposits. Limits and KYC requirements vary by location and operator, so check details before use.

-

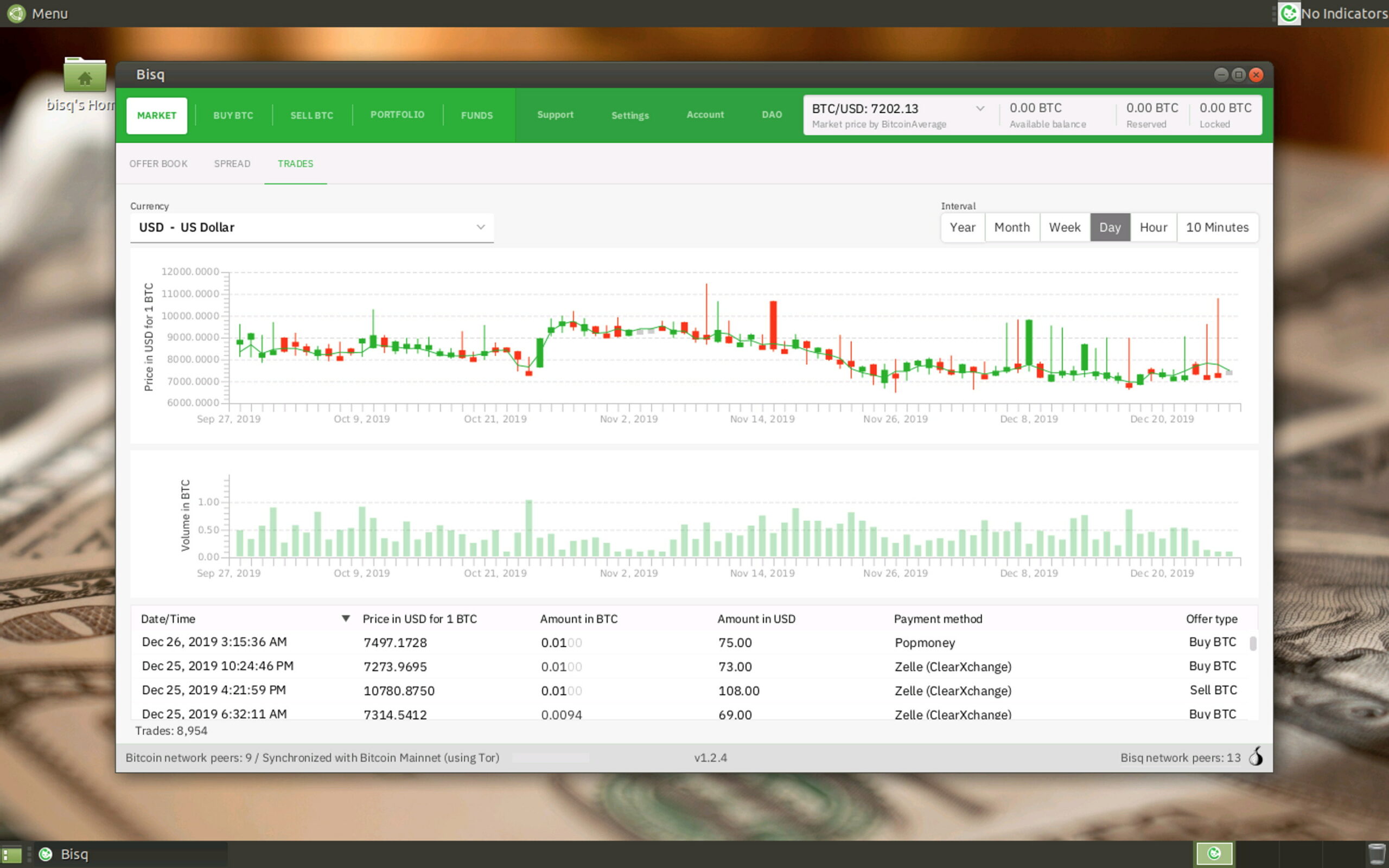

Decentralized Exchanges (DEXs) + P2P Cash Trades: Use DEXs like Bisq to trade crypto for fiat with other users. Bisq supports cash deposit and cash-in-mail options, prioritizing privacy and requiring no central account.

-

Non-KYC Crypto Debit Cards for In-Store Purchases: Providers like No KYC Cards and FirstCryptoCard offer virtual crypto debit cards usable via Apple Pay or Google Pay. While they do not support ATM cash withdrawals, they enable anonymous in-store spending, which can sometimes be used indirectly to obtain cash (e.g., by purchasing items and reselling them for cash).

Peer-to-peer (P2P) exchanges remain one of the most robust options. Platforms that don’t require KYC allow you to connect directly with buyers or sellers who can facilitate local cash trades. While this method is more complex than using an ATM, it keeps your identity off centralized ledgers. Always use escrow services and vet counterparties carefully to avoid scams.

Decentralized exchanges (DEXs) paired with anonymous wallets can also help you convert crypto into privacy coins like Monero before seeking out local cash buyers. For those willing to travel further down the privacy rabbit hole, community meetups or trusted OTC brokers can provide off-the-record fiat access, but these routes require diligence and a strong understanding of local laws.

Staying Ahead: Privacy Trends in Crypto Cards

The landscape is evolving quickly. As regulators tighten oversight, developers are innovating new tools that balance compliance with user sovereignty. Expect future no-KYC solutions to focus even more on online spending flexibility rather than physical cash withdrawals. The rise of anonymous wallets (see Cryptonews’ 14 Best Anonymous Crypto Wallets With No KYC in 2025) and decentralized identity protocols will empower users to control their data while staying compliant where necessary.

The bottom line: If your priority is spending crypto privately without revealing your identity, stick with reputable no-KYC cards for online shopping or contactless retail payments via Apple Pay or Google Pay integrations. For anonymous cash access, explore P2P swaps carefully, but always weigh the legal implications and personal risks involved.