For crypto enthusiasts and privacy advocates, the surge in no-KYC crypto credit cards is transforming how we shop online. In 2024, the demand for anonymous payment solutions has never been higher, fueled by growing concerns over data privacy and regulatory scrutiny. No-KYC (Know Your Customer) cards allow users to spend digital assets while bypassing intrusive identity checks, providing a unique blend of financial freedom and convenience.

Why Choose a No-KYC Crypto Credit Card for Online Purchases?

The appeal of an anonymous crypto credit card lies in its ability to let you transact globally without exposing your identity. For many, this isn’t just about privacy – it’s about security and autonomy. With increasing reports of data breaches at traditional financial institutions, protecting your personal information is more important than ever.

No-KYC crypto cards are also ideal for those who value speed and accessibility. Traditional card issuers can take days (or even weeks) to approve accounts due to lengthy verification processes. In contrast, no-KYC solutions offer near-instant issuance so you can start spending your crypto within minutes.

The Best No-KYC Crypto Credit Cards for 2024: Curated List

Top No-KYC Crypto Credit Cards for Online Purchases (2024)

-

Tokyniq Anonymous Crypto Card: Tokyniq offers a truly no-KYC crypto card designed for privacy-focused users. Funded with major cryptocurrencies, it enables anonymous online purchases and features low fees. Tokyniq is praised for its ease of use and commitment to user anonymity, making it a top choice for those seeking discretion.

-

BloFin No-KYC Crypto Card: BloFin’s card is issued through its popular no-KYC crypto exchange, allowing users to buy and spend crypto online without ID verification. Supporting over 400 cryptocurrencies, it provides flexibility and privacy for global users, and is well-regarded for its seamless online transaction process.

-

BitCard Prepaid Visa (No Verification Option): BitCard offers a prepaid Visa card with a no-verification option, enabling users to load crypto and spend it online worldwide. Its prepaid structure helps manage spending, and the no-KYC tier is ideal for those prioritizing privacy in their online purchases.

-

Paycent Crypto Debit Card (Lite KYC Tier): Paycent’s card features a Lite KYC tier that requires minimal verification, granting access to a wide range of crypto-funded online transactions. It supports multiple cryptocurrencies and is accepted by most online merchants, balancing privacy with broad usability.

-

CoinsPaid Virtual Crypto Card: CoinsPaid offers a virtual crypto card that enables anonymous online shopping with crypto. With fast issuance and support for major cryptocurrencies, it’s a practical option for those seeking privacy and convenience in their online purchases.

Let’s examine the top contenders that have set themselves apart in 2024:

Tokyniq Anonymous Crypto Card

Tokyniq is frequently cited on forums like r/Bitcoin as one of the most private options available this year. Its virtual card issuance process requires no KYC documentation whatsoever. Users can fund their Tokyniq card with leading cryptocurrencies such as Bitcoin (BTC), Ethereum (ETH), or stablecoins like USDT. The platform boasts low fees and compatibility with major payment networks, making it an excellent choice for those seeking true anonymity on everyday online purchases.

No KYC required, low fees, as private and anonymous as possible, my go-to for online shopping! – Reddit user review

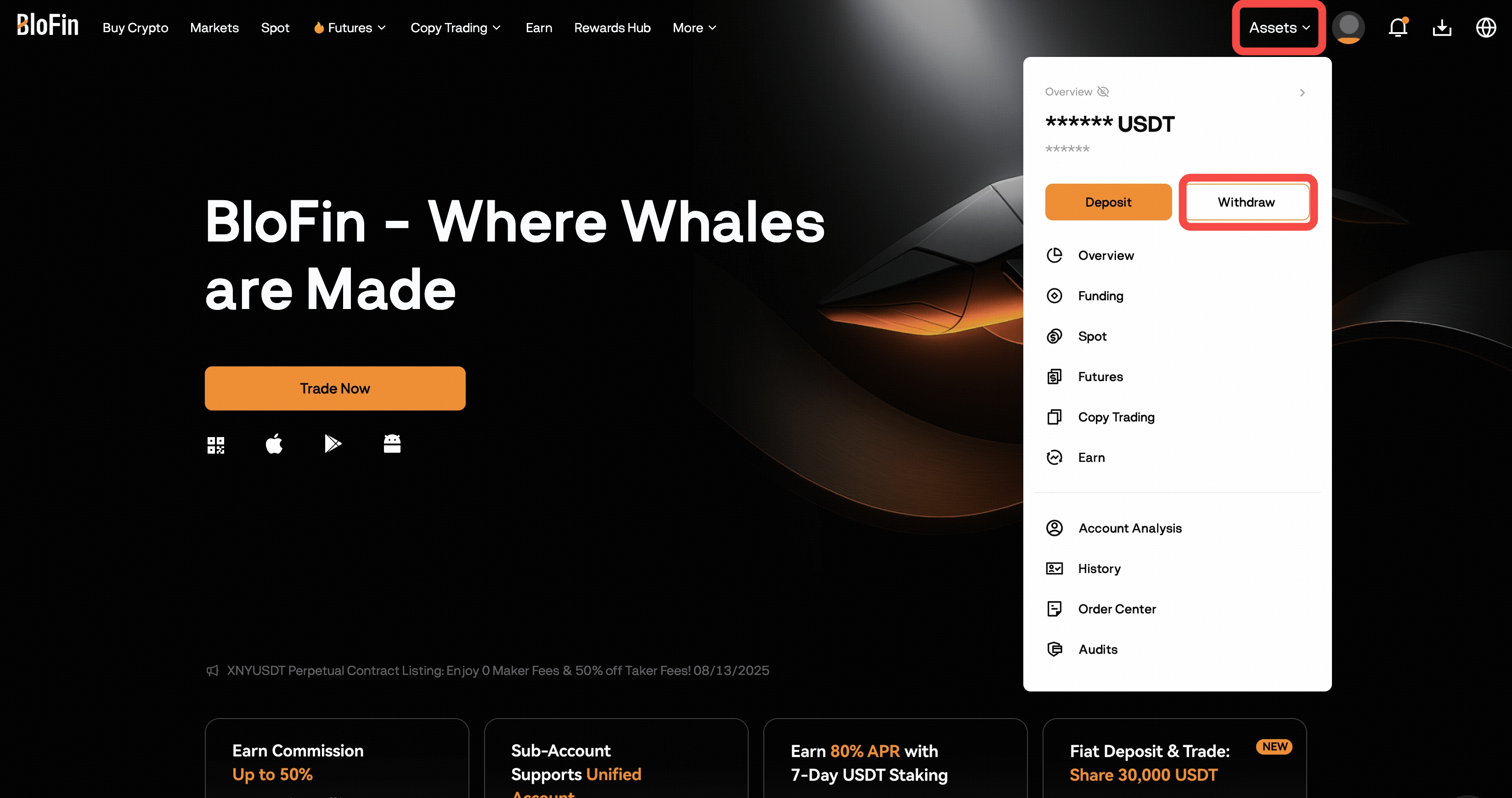

BloFin No-KYC Crypto Card

BloFin has rapidly gained traction thanks to its robust support for over 400 cryptocurrencies and seamless integration with its no-KYC exchange platform. With BloFin’s card solution, you can buy Bitcoin or other assets using a credit card without verification, then load your virtual or physical card instantly. This makes it especially attractive for users who want flexibility across multiple chains while maintaining privacy.

BitCard Prepaid Visa (No Verification Option)

The BitCard Prepaid Visa stands out by offering a no-verification tier that enables users to access prepaid Visa cards funded directly with crypto. This means you can convert digital assets into spendable fiat without enduring lengthy onboarding procedures. BitCard supports instant issuance and global acceptance wherever Visa is recognized – making it particularly useful for international shoppers looking to maximize both privacy and convenience.

Navigating Lite KYC Tiers: Paycent and CoinsPaid Virtual Cards

If you’re willing to accept minimal verification in exchange for higher limits or added features, there are hybrid options worth considering:

- Paycent Crypto Debit Card (Lite KYC Tier): Paycent offers a flexible approach with its Lite KYC tier – requiring only basic information but not full identity documents. This strikes a balance between anonymity and functionality, allowing higher transaction volumes while still respecting user privacy.

- CoinsPaid Virtual Crypto Card: CoinsPaid provides virtual cards that can be funded from your wallet without traditional KYC barriers. The service emphasizes user control over personal data while supporting seamless online transactions across popular e-commerce platforms.

Each of these no-KYC crypto cards has its own strengths, making them suitable for different privacy preferences and spending needs. Let’s break down what makes these products stand out in the current market:

Feature Comparison: Top No-KYC Crypto Credit Cards

-

Tokyniq Anonymous Crypto Card: Offers a fully anonymous crypto card with no KYC required. Supports major cryptocurrencies like BTC, ETH, and USDT. Features low fees, instant virtual issuance, and broad online acceptance. Prioritizes privacy and ease of use for global users.

-

BloFin No-KYC Crypto Card: Provided by the BloFin exchange, this card allows users to spend crypto online without ID verification. Supports over 400 cryptocurrencies. Known for its user-friendly app and fast card issuance.

-

BitCard Prepaid Visa (No Verification Option): A prepaid Visa card that can be loaded with crypto and used online without full KYC. Offers instant virtual card creation, compatibility with major retailers, and transparent fee structure.

-

Paycent Crypto Debit Card (Lite KYC Tier): Paycent’s Lite KYC tier enables users to access a crypto debit card with minimal identity verification. Supports multiple cryptocurrencies, global online shopping, and mobile wallet integration.

-

CoinsPaid Virtual Crypto Card: CoinsPaid offers a virtual crypto card with streamlined onboarding and minimal KYC requirements. Allows for secure online purchases using crypto, with a focus on privacy and fast setup.

Key Considerations When Choosing Your Card

Before selecting a card for your online purchases, it’s crucial to assess several factors:

- Privacy Level: Cards like Tokyniq and BitCard allow you to remain virtually anonymous, while Paycent’s Lite KYC tier offers a middle ground for those comfortable with basic info sharing.

- Supported Cryptocurrencies: BloFin leads in asset diversity, supporting over 400 cryptos. If you hold niche tokens or want flexibility across blockchains, this breadth is invaluable.

- Fees and Limits: Read the fee schedules carefully. Some cards charge higher reload or transaction fees in exchange for privacy. For example, prepaid options may have activation costs but no monthly maintenance.

- User Experience: Instant issuance and integration with Apple Pay or Google Pay can be game changers for frictionless shopping.

Security Best Practices for Anonymous Crypto Spending

No-KYC does not mean no risk. To maximize both your privacy and security when using these cards:

- Select reputable providers with transparent terms and proven track records.

- Avoid sharing card details on unsecured websites or public Wi-Fi networks.

- Enable two-factor authentication where possible to protect your account access.

- Monitor balances regularly, especially when using virtual cards that don’t offer robust dispute resolution mechanisms.

How No-KYC Crypto Cards Are Shaping the Future of Online Shopping

The rise of these solutions signals a shift toward user-centric finance. As more people demand control over their data and seek alternatives to traditional banks, we can expect further innovation in the space. The five products highlighted here, Tokyniq Anonymous Crypto Card, BloFin No-KYC Crypto Card, BitCard Prepaid Visa (No Verification Option), Paycent Crypto Debit Card (Lite KYC Tier), and CoinsPaid Virtual Crypto Card, demonstrate that privacy-first financial tools are not only viable but thriving.

If you value financial autonomy without compromising usability, exploring these options is worthwhile. Just remember: always check that your chosen provider complies with regulations in your jurisdiction before loading funds or making large purchases. Responsible use will ensure you enjoy both freedom and peace of mind as you navigate the evolving world of crypto payments.