Privacy-focused crypto users are increasingly searching for ways to spend their digital assets globally, without the friction of identity verification. In 2025, the rise of no-KYC crypto debit cards with high spending limits is reshaping how individuals access and use their cryptocurrency. These cards are not only about anonymity, they also deliver practical solutions for high-limit, everyday purchases, travel, and online shopping, all while sidestepping intrusive KYC processes.

Why High-Limit No-KYC Crypto Debit Cards Are in Demand

The demand for high limit crypto cards stems from a blend of privacy concerns, regulatory uncertainty, and the need to move large sums efficiently. Traditional financial institutions often impose restrictive KYC checks that can delay access or even exclude users entirely. For those valuing financial autonomy, no-KYC cards offer an elegant workaround, enabling users to spend crypto as fiat without KYC, whether at point-of-sale terminals or online merchants worldwide.

The cards in this guide have been carefully selected for their ability to combine robust spending limits with minimal identity requirements. They support a range of cryptocurrencies and provide seamless conversion to fiat currencies like USD or EUR at competitive rates.

The Top 5 No-KYC Crypto Debit Cards With High Spending Limits in 2025

Here’s an expert breakdown of the best options available this year for those seeking both privacy and flexibility:

Top No-KYC Crypto Debit Cards for High Limits (2025)

-

Bitpay Card (No-KYC Virtual Option): The Bitpay Card offers a virtual prepaid Mastercard that can be obtained with minimal KYC for low spending limits, allowing users to spend crypto as fiat in the U.S. Supported coins include BTC, ETH, LTC, DOGE, BCH, DAI, USDC, GUSD, BUSD, PAX. The card features no annual fee, a $10,000 monthly spending cap for no-KYC users, and a 3% foreign transaction fee.

-

Paycent Crypto Debit Card: Paycent provides both physical and virtual cards with a no-KYC option for lower tiers. Users can spend BTC, ETH, LTC, DASH, XRP, and BCH globally. No-KYC cards have a $5,000 daily spending limit, a 2.5% conversion fee, and a $1.50 ATM withdrawal fee.

-

CoinsPaid Crypto Debit Card: CoinsPaid offers a virtual debit card with no-KYC onboarding for basic tiers. The card supports BTC, ETH, USDT, USDC, BCH, LTC, and can be used for online and in-store purchases. No-KYC users enjoy a $3,000 daily spending limit and a 2% transaction fee.

-

ClubSwan Debit Card (Basic Tier, No-KYC): ClubSwan’s basic tier allows for a no-KYC virtual or physical card with a $2,500 daily spending limit. It supports BTC, ETH, LTC, BCH, XRP, USDT, and EUR/GBP/USD for spending and conversion. Fees include a 1.5% top-up fee and a €10 monthly maintenance fee.

-

AdvCash Crypto Card (No-KYC for Low-Mid Tiers): AdvCash enables users to order a virtual or physical card with no KYC for lower tiers. Supported assets include BTC, ETH, BCH, LTC, USDT, XRP, EUR, USD. No-KYC cards have a $2,500 monthly spending cap and a 1% card loading fee.

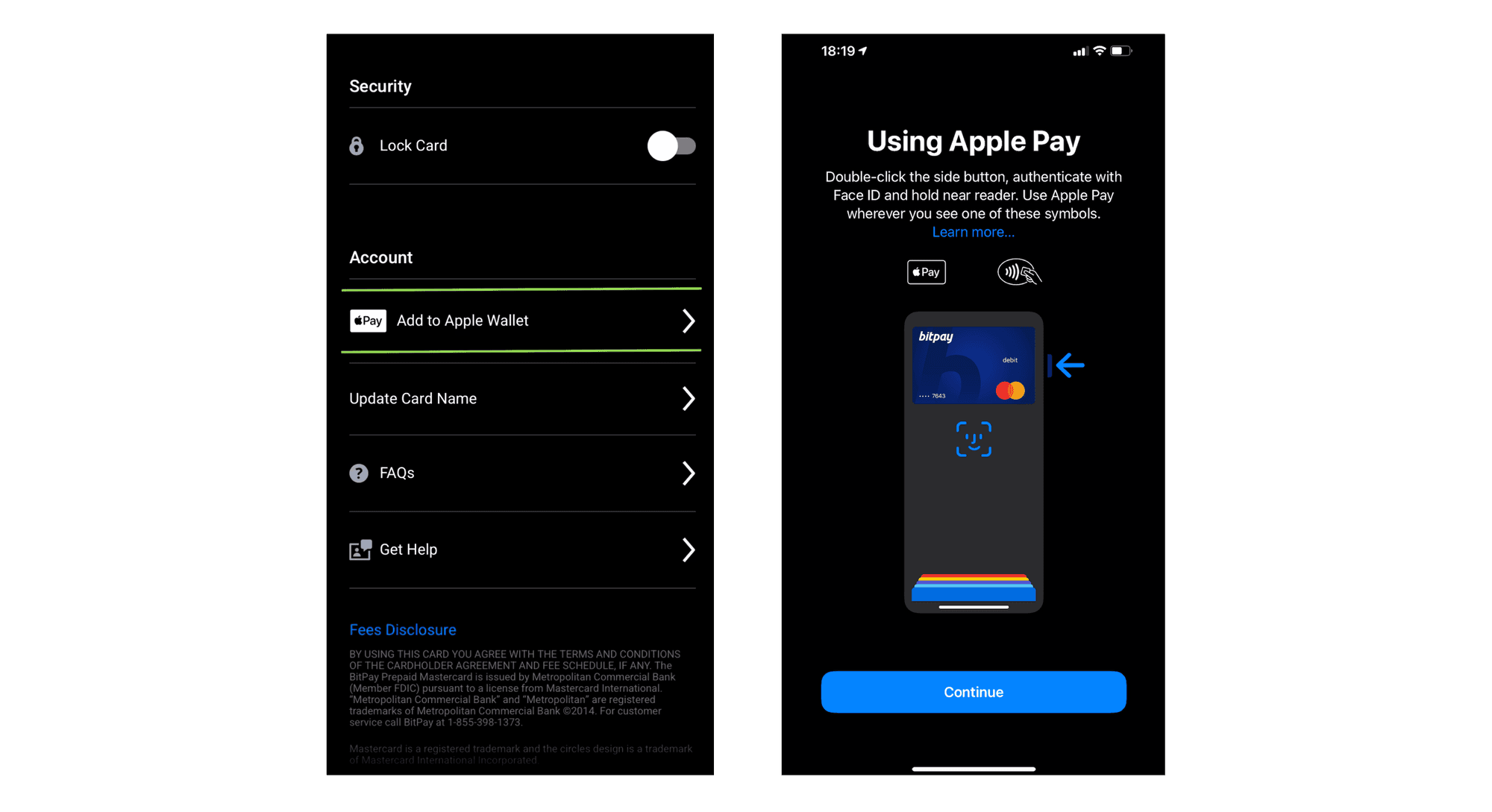

1. Bitpay Card (No-KYC Virtual Option)

The Bitpay Card stands out for its streamlined virtual card offering that requires no KYC for basic usage. Users can generate a virtual card instantly and top up using Bitcoin or other major cryptocurrencies. The spending cap is competitive, often suitable for high-volume online purchases or recurring payments. Bitpay’s platform supports instant conversion from crypto to fiat at market rates with transparent fees.

Key features:

- No personal documentation required for virtual card issuance

- Supports BTC, ETH, USDC, BCH and more

- Works with Apple Pay and Google Pay for contactless payments

- Competitive daily and monthly spend limits (refer to Bitpay’s latest terms)

2. Paycent Crypto Debit Card

The Paycent card is renowned among privacy advocates due to its flexible KYC structure, allowing significant spending before any verification is triggered. It supports a broad suite of cryptocurrencies including BTC, LTC, ETH and Dash. With global acceptance across millions of merchants and ATMs, it’s ideal for frequent travelers or remote workers who want immediate access to funds without revealing their identity.

Main advantages:

- No KYC needed up to defined transaction thresholds (check current caps)

- Multi-currency support: USD, EUR, GBP and more

- Straightforward mobile app integration

- Low FX conversion fees compared to many competitors

3. CoinsPaid Crypto Debit Card

CoinsPaid has built its reputation on speed and discretion. Their no-KYC debit card option enables users to fund accounts directly from non-custodial wallets, meaning you retain control over your private keys until the moment you spend. With generous monthly limits tailored for power users and robust security protocols in place, CoinsPaid is a strong contender if you prioritize both privacy and high throughput.

What sets CoinsPaid apart:

- No ID documents required below set annual volume thresholds

- Supports a wide variety of coins including stablecoins like USDT and DAI

- User-friendly dashboard with real-time balance updates

Navigating Fees, Limits and Security When Choosing Your Anonymous Crypto Card

Selecting the right anonymous crypto card involves balancing several factors beyond just skipping KYC forms:

- Spending Limits: Each provider sets unique caps on daily/monthly usage; always check if these fit your needs before committing funds.

- Fees: Watch out for issuance costs (often $5-$100), top-up charges (typically 2-5%), ATM withdrawal fees (upwards of 3%), as well as foreign exchange markups when spending abroad.

- Currencies Supported: Some cards only allow top-ups in select coins or restrict withdrawals to certain fiat currencies, ensure your preferred assets are compatible.

This landscape continues evolving rapidly as providers respond to user demand, and regulatory pressure, to create products that maximize both freedom and compliance flexibility.

4. ClubSwan Debit Card (Basic Tier, No-KYC)

ClubSwan’s basic tier debit card is a favorite for those who want the prestige of a premium brand without sacrificing privacy. At this entry level, ClubSwan allows users to order and activate their debit card with minimal information, typically just an email and basic contact details. There’s no need to upload identification documents for the basic tier, making it a go-to solution for privacy maximalists who still want access to high daily and monthly spending limits.

- No KYC required for basic tier sign-up

- Supports BTC, ETH, LTC, BCH, and several stablecoins

- Physical and virtual cards available

- Global ATM access with competitive withdrawal limits

- Tiered upgrade paths if you later choose to unlock even higher limits (with KYC)

5. AdvCash Crypto Card (No-KYC for Low-Mid Tiers)

The AdvCash Crypto Card offers a unique approach: users can access low- and mid-tier spending levels without submitting full KYC documentation. This makes AdvCash especially appealing for those who value both flexibility and incremental privacy, the ability to spend freely within set thresholds before any verification is required. The platform’s integration with multiple cryptocurrencies and fiat currencies provides seamless conversion at sharp rates.

- No KYC required for initial tiers

- Multi-currency support: BTC, ETH, USDT, EUR, USD, GBP

- Instant card issuance, virtual or physical options available

- Reasonable daily/monthly spending caps (check AdvCash’s current terms)

- Straightforward mobile wallet interface

Comparing the Top No-KYC Crypto Debit Cards of 2025

The table below summarizes the standout features of each card discussed above, helping you quickly assess which best aligns with your needs as a high-limit crypto spender seeking anonymity:

Comparison of Top No-KYC Crypto Debit Cards for High Spending Limits (2025)

| Card Name | Fees | Supported Coins | Spend Limits |

|---|---|---|---|

| Bitpay Card (No-KYC Virtual Option) | No issuance fee for virtual card; transaction fees vary by usage and network | BTC, ETH, BCH, LTC, DOGE, USDC, DAI, and more | Up to $2,500 per day for virtual card (no-KYC); higher with KYC |

| Paycent Crypto Debit Card | $49 issuance fee; 1.5% conversion fee; ATM withdrawal fees apply | BTC, ETH, LTC, DASH, XRP, BCH, and more | Up to $5,000 per day (no-KYC tier) |

| CoinsPaid Crypto Debit Card | €10 issuance fee; 1% top-up fee; ATM fees vary | BTC, ETH, USDT, USDC, BCH, LTC, and more | Up to €2,000 per day (no-KYC tier) |

| ClubSwan Debit Card (Basic Tier, No-KYC) | £20 monthly fee; 2% transaction fee; ATM fees apply | BTC, ETH, BCH, LTC, USDT, and more | Up to £5,000 per month (Basic tier, no-KYC) |

| AdvCash Crypto Card (No-KYC for Low-Mid Tiers) | $1 monthly fee; 0.5% top-up fee; ATM withdrawal fees apply | BTC, ETH, LTC, BCH, XRP, USDT, and more | Up to $3,000 per month (no-KYC for low-mid tiers) |

When evaluating these 2025 no-KYC crypto cards, keep in mind that spending caps may shift as providers adapt to new regulations or market demand. Always verify the latest terms directly on each platform before funding your card.

Risks and Responsible Use of Anonymous Crypto Cards

No-KYC debit cards offer clear benefits, privacy protection and frictionless onboarding, but they also carry risks not found in traditional banking products. Without identity verification:

- If your card is lost or stolen, recovering funds can be difficult or impossible.

- Your account may be more vulnerable to fraud if login credentials are compromised.

- Certain jurisdictions may restrict or ban the use of anonymous payment tools, always check local laws before use.

For larger sums or frequent transactions, consider using multi-signature wallets or splitting balances across several providers as an added layer of security.

The evolution of high limit crypto cards without intrusive checks is empowering users worldwide to take control of their assets while preserving privacy. As new entrants emerge and existing players refine their offerings in response to user feedback and regulatory shifts, expect even more innovative solutions on the horizon. For now, these five cards remain at the forefront, balancing ease-of-use with robust spending power in a landscape that increasingly values financial autonomy.