For crypto enthusiasts in 2025, true financial privacy is about more than just holding coins in a non-custodial wallet. It’s about spending your digital assets globally without handing over your identity at every turn. As regulatory scrutiny tightens, finding no KYC crypto credit cards that balance privacy, usability, and flexibility has never been more important. Below, we break down the 10 best options for anonymous crypto cardholders seeking to keep their personal data off the grid while enjoying seamless global spending.

Why No-KYC Crypto Credit Cards Matter More Than Ever

The days of easy anonymity in the crypto world are fading fast. Governments worldwide have ramped up enforcement of Know Your Customer (KYC) rules, making fully anonymous payment options increasingly rare. Yet demand for privacy crypto cards continues to surge among users who value freedom and discretion. Whether you’re a digital nomad or just want to keep your spending private, these no-KYC cards offer a practical solution, if you know where to look.

The following list is curated for 2025’s most privacy-focused users. We’ve compared cards based on KYC requirements, supported cryptocurrencies, fees, spending limits, and global acceptance. If you want an in-depth comparison or additional picks beyond this top 10, check out our complete guide at this resource.

Top 10 No-KYC Crypto Credit Cards for Privacy in 2025

Top 10 No-KYC Crypto Credit Cards for 2025

-

ClubSwan Card: Combining luxury and privacy, ClubSwan offers a crypto debit card with minimal KYC requirements for lower-tier accounts. Users can spend BTC, ETH, and USDT globally, benefit from multi-currency support, and enjoy concierge services for premium members.

-

MondoGate Crypto Credit Card: MondoGate provides a versatile crypto card with a streamlined onboarding process. Users can spend multiple cryptocurrencies and enjoy low fees, making it a practical choice for privacy-focused individuals who want global acceptance.

-

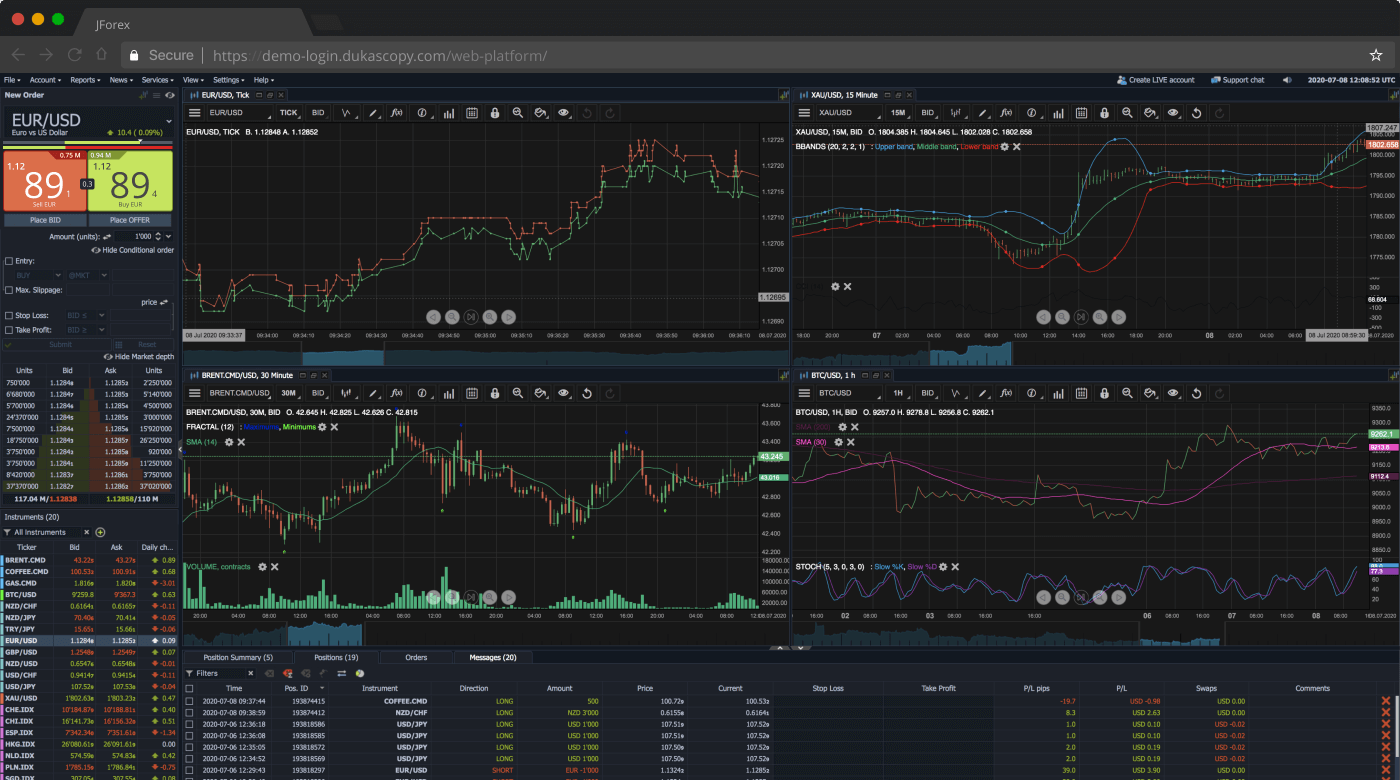

Dukascopy Crypto Card: Issued by the Swiss digital bank Dukascopy, this card supports crypto-to-fiat spending with minimal verification for low-volume users. It offers SEPA transfers, multi-currency wallets, and integration with major cryptocurrencies.

-

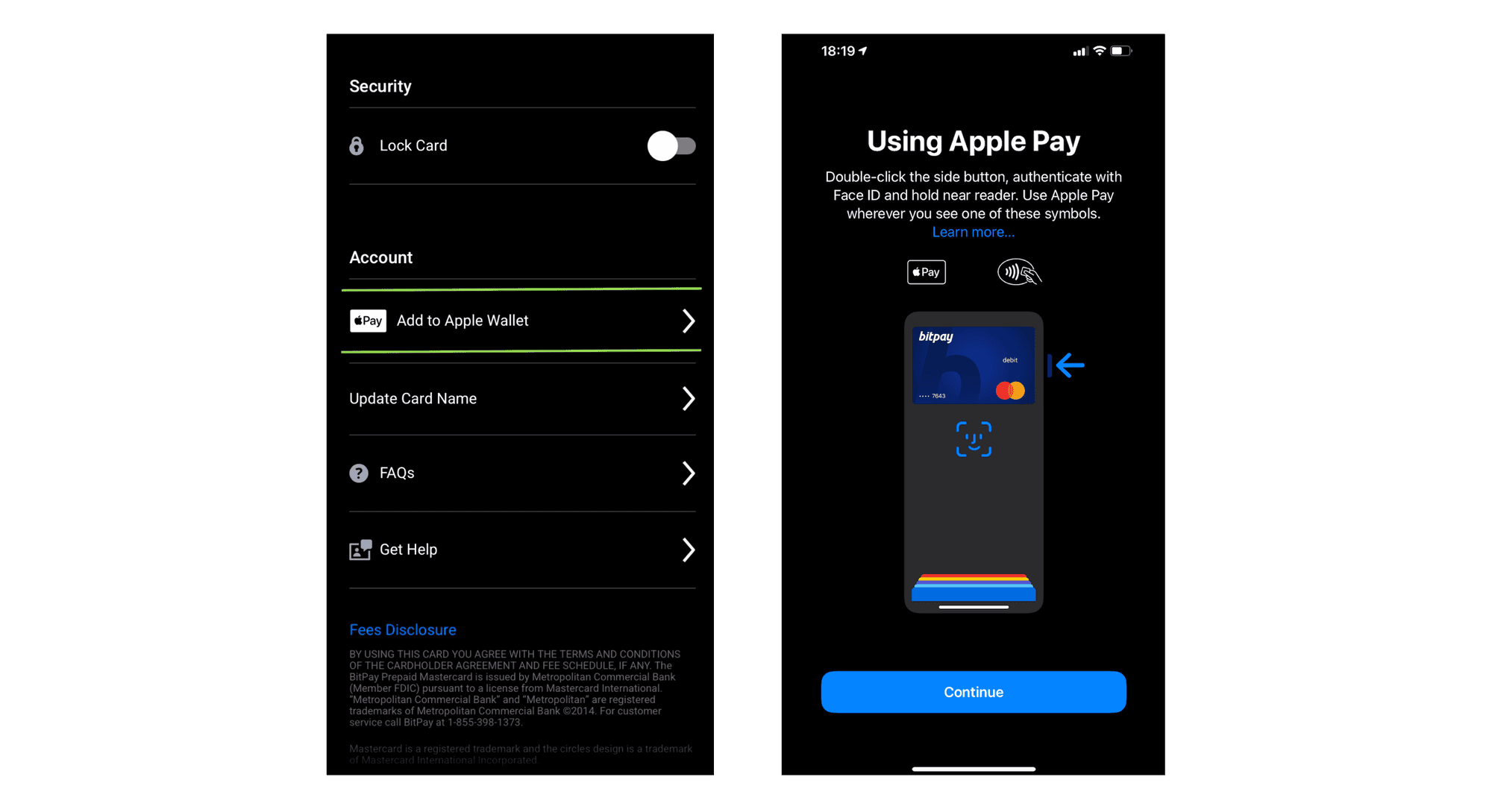

Bitpay Prepaid Mastercard (No-KYC Option): Bitpay’s prepaid Mastercard allows select users to access a no-KYC option for lower limits. The card is accepted worldwide, supports instant crypto-to-fiat conversion, and is known for its transparent fee structure.

-

Paycent Crypto Debit Card: Paycent offers a globally accepted debit card with flexible KYC tiers. Lower tiers require minimal identity checks, allowing users to spend BTC, ETH, LTC, and more, with real-time conversion and mobile app management.

-

SpectroCoin Prepaid Card: SpectroCoin’s prepaid card enables crypto holders to spend BTC, ETH, and other assets with minimal KYC for small amounts. The card is usable online and at ATMs, supporting both EUR and USD balances.

-

Uquid Crypto & DeFi Virtual Visa Card: Uquid’s virtual Visa card is a favorite for privacy advocates, offering a no-KYC option for low-value cards. Users can top up with various cryptocurrencies and use the card for global online purchases.

-

Advcash Crypto Card: Advcash provides a crypto-linked card with flexible KYC requirements. For lower limits, users can access the card with basic verification, spending BTC, ETH, and stablecoins both online and in-store.

-

Change Invest Crypto Card: Change Invest’s card allows users to spend crypto with minimal onboarding for smaller amounts. The card supports instant conversion, is accepted at millions of merchants, and integrates with a user-friendly mobile app.

-

CoinsPaid Crypto Card: CoinsPaid offers a prepaid card solution with straightforward registration and no mandatory KYC for low-volume users. The card supports major cryptocurrencies and is ideal for privacy-focused spending worldwide.

Let’s dive into what sets each of these cards apart, and how they stack up for privacy-minded spenders.

1. ClubSwan Card: Premium Privacy Meets Global Access

ClubSwan stands out as a luxury option for those who want both privacy and VIP perks. While it offers tiered membership levels with varying fees and benefits, including concierge services, its biggest draw is minimal KYC below certain thresholds. You can fund your card with BTC or USDT and spend globally in multiple fiat currencies without intrusive verification steps for lower tiers.

- KYC Level: Minimal (for lower-tier usage)

- Currencies Supported: BTC, ETH, USDT and major fiat

- Key Feature: High daily limits and exclusive member rewards

- Drawback: Higher fees at premium tiers; full KYC if you upgrade limits

2. MondoGate Crypto Credit Card: Flexible Spending Without Identity Checks

MondoGate’s card is engineered for everyday use by privacy advocates. It enables anonymous top-ups with leading cryptocurrencies like BTC and ETH and supports instant virtual card issuance, no documentation required for basic accounts.

- KYC Level: None (for standard limits)

- Currencies Supported: BTC, ETH, USDT and others

- Main Perk: Virtual/physical cards usable via Apple Pay and Google Pay

- Caveat: Monthly cap applies before further verification is needed

Dukascopy Crypto Card: Swiss Reliability With Low Verification Barriers

If you’re looking for European compliance without sacrificing too much privacy, Dukascopy’s crypto card is worth considering. The Swiss-based bank offers prepaid Mastercards that can be loaded with various cryptocurrencies, and while some KYC exists at account creation, it’s far lighter than traditional banks require.

- KYC Level: Basic (email/phone; no document upload for low volumes)

- Currencies Supported: BTC and select altcoins and fiat pairs

- Main Strength: Swiss banking reliability; competitive conversion rates

- Pitfall: Advanced features require extra verification steps

The Bitpay Prepaid Mastercard (No-KYC Option): Streamlined US Access With Minimal Friction

The Bitpay Prepaid Mastercard (No-KYC Option), available in select regions and through specific channels in 2025, lets users create an account with just an email address, no ID upload required under certain thresholds.

- KYC Level: None/minimal depending on usage volume

- Currencies Supported: BTC plus major stablecoins

- Main Perk: Fast virtual card setup; wide merchant acceptance

- Pitfall: Not all features available without full verification

If you’re interested in exploring more about how these options compare side-by-side, including fee breakdowns and regional restrictions, visit our updated comparison page at this link here.

Paycent Crypto Debit Card: Multi-Currency Flexibility With Light Verification

For users who need to switch between crypto and fiat on the fly, Paycent offers a versatile debit card with low entry barriers. You can top up with BTC, ETH, LTC, and several stablecoins, then spend in USD, EUR, or GBP. The Paycent card is available as both virtual and physical plastic, and for lower monthly volumes it requires only basic information, no document upload. The app makes it easy to track balances and spending in real time.

- KYC Level: Minimal (email/phone for basic limits)

- Currencies Supported: BTC, ETH, LTC, USDT, BNB and fiat

- Main Perk: Instant crypto-to-fiat conversion; global ATM access

- Pitfall: Higher withdrawal fees than some competitors

SpectroCoin Prepaid Card: Fast Issuance With Pseudonymous Use

The SpectroCoin Prepaid Card lets you go from wallet to checkout in minutes. Users can order a virtual or physical card with just an email and phone number for modest spending limits. Top up with BTC or ETH and spend online or at any Mastercard merchant worldwide. If you want higher daily caps or ATM withdrawals above a certain level, additional verification is required, but for most privacy-focused users staying under thresholds, this is a solid pseudonymous option.

- KYC Level: Basic (no documents for small loads)

- Currencies Supported: BTC, ETH and major fiat currencies

- Main Perk: Rapid issuance; strong EU support

- Pitfall: Limited perks compared to premium cards

Uquid Crypto and DeFi Virtual Visa Card: DeFi Power With No ID Uploads Required

If you’re deep into decentralized finance but want to spend without hurdles, the Uquid Crypto and DeFi Virtual Visa Card stands out. Sign up with just an email address; no KYC documents are needed for standard usage tiers. The card supports dozens of tokens directly from DeFi wallets and offers instant issuance, perfect for keeping your identity off centralized exchanges.

- KYC Level: None (for standard spending limits)

- Currencies Supported: Wide range including BTC, ETH, BNB Chain tokens and stablecoins

- Main Perk: Direct integration with DeFi protocols; virtual instant use via Google/Apple Pay

- Pitfall: Higher fees on some smaller altcoin conversions

Advcash Crypto Card: Hybrid Solution For Global Privacy Seekers

The Advcash platform is known for its balance between privacy and utility. Their crypto card allows you to fund via BTC or USDT without submitting ID below certain thresholds. It’s available as both a virtual Visa/Mastercard and a physical plastic card shipped worldwide. Advcash’s dashboard offers advanced security features including two-factor authentication and transaction alerts.

- KYC Level: Minimal (no ID for basic loads/spending)

- Currencies Supported: BTC, USDT and EUR/USD/RUB fiat pairs

- Main Perk: Flexible account management; robust security tools

- Pitfall: Not all countries supported due to evolving regulations

Change Invest Crypto Card: European Simplicity With Quick Setup

The Change Invest card appeals to EU-based users who want minimal hassle when moving from crypto savings to daily purchases. Basic verification (email/phone) gets you started, no passport scans needed under default limits. Users can top up with Bitcoin or Ethereum directly from the Change app and benefit from instant notifications plus competitive FX rates.

- KYC Level: Basic (no document upload below cap)

- Currencies Supported: BTC, ETH and EUR/GBP/USD fiats

- Main Perk: Fast onboarding; integrated app experience

- Pitfall: Only available in select European countries