Imagine loading Bitcoin straight from your wallet and tapping to pay at any merchant worldwide, all without flashing your passport or utility bill. That’s the reality with the OffGrid no KYC crypto card in 2026, a virtual powerhouse for anonymous crypto spending. As someone who’s navigated crypto’s wild rides for a decade, I can tell you this card cuts through the privacy pitfalls that plague traditional options. Spend up to $4,000 per month seamlessly, no identity trails left behind.

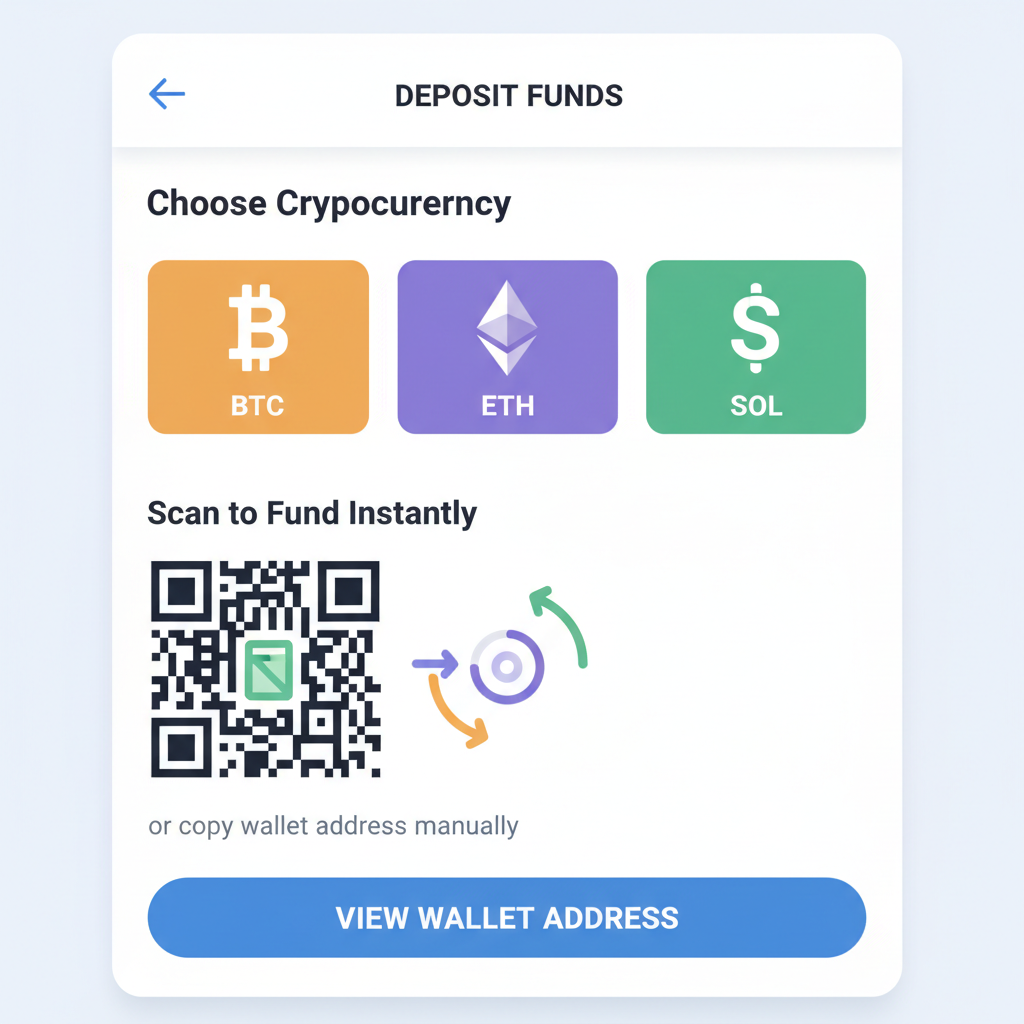

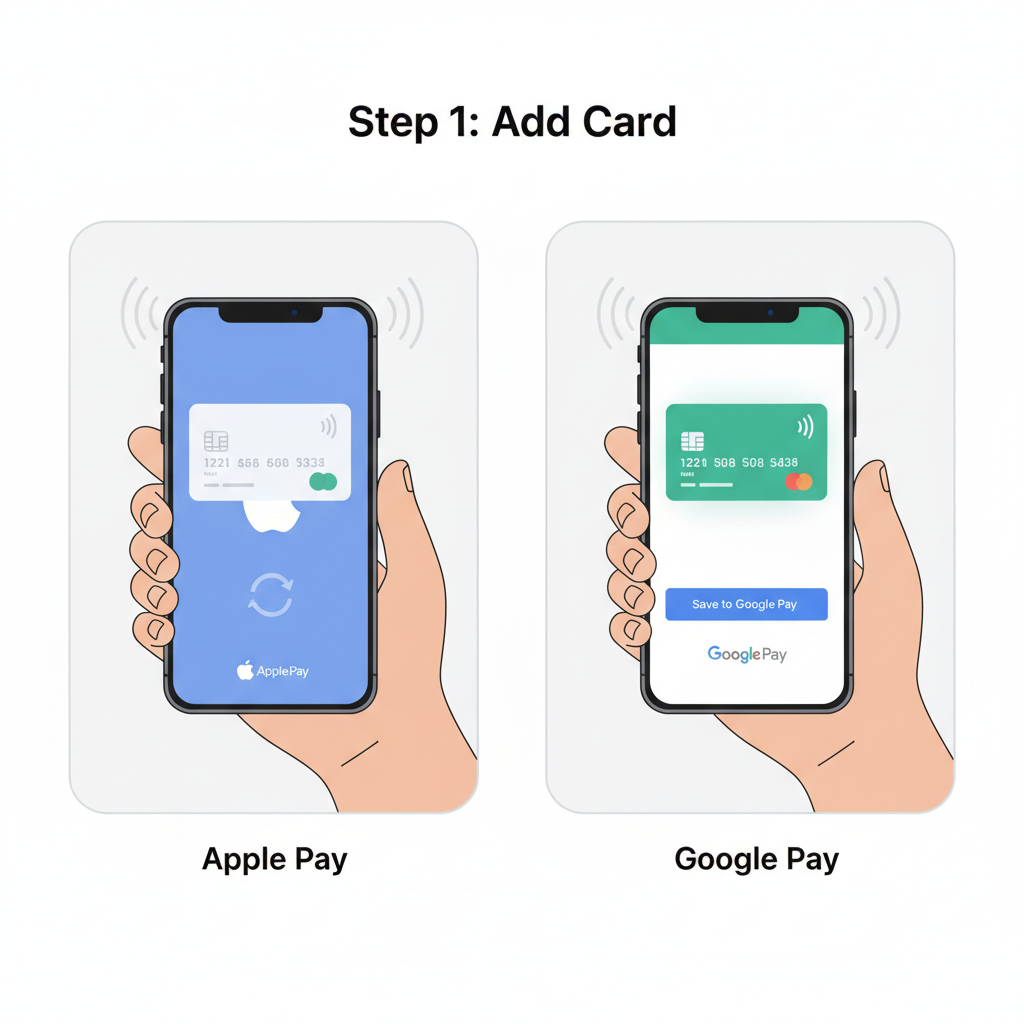

OffGrid (@offgridcash) has built a reputation by tackling head-on what KYC crypto cards get wrong. Governments peering into your transactions? Restricted countries locked out? No more. This offgrid crypto card prioritizes your financial sovereignty, letting you fund with BTC, ETH, SOL, or stablecoins via a privacy-focused app or web dashboard. Instant top-ups mean your crypto converts to spendable balance in seconds, ready for Apple Pay or Google Pay integration.

Why Privacy-First Design Sets OffGrid Apart

In my trading workshops, I hammer home the volatility edge privacy tools provide. OffGrid embodies that with zero personal data collection. Unlike neobanks or KYC-heavy cards listed in CoinGecko’s top 10 for 2026, which demand verification and expose you to blocks in sanctioned regions, OffGrid operates on a simple premise: load crypto, spend anywhere. Their X posts highlight the frustrations perfectly, echoing Reddit threads where users ditch KYC nightmares for shadow identities and anonymous wallets.

Think about it practically. You’re at a festival eyeing crypto payments at cashless bars, as debated in 2026 event guides. OffGrid’s virtual card slips right into your digital wallet, no BIN sponsorship hassles or low-limit soft-KYC traps from white-label providers. It’s engineered for everyday use: groceries, gas, even no-verification betting sites if that’s your scene. And with regulatory variances noted, it stays compliant without compromising your anonymity.

Key OffGrid No-KYC Features

-

$4,000 monthly spend limit – load and spend up to $4K/month without ID checks for everyday purchases worldwide.

-

BTC/ETH/SOL/stablecoin funding – top up easily with Bitcoin, Ethereum, Solana, or stablecoins via app or web dashboard.

-

Apple Pay/Google Pay compatible – add your virtual OffGrid card for seamless contactless payments anywhere.

-

Instant top-ups – fund your card in seconds for non-stop spending without delays.

-

No data storage for max privacy – zero personal data collected or stored, keeping transactions fully anonymous.

Effortless Funding and Global Reach

Getting your anonymous crypto spending card live takes minutes. Download the app, generate your virtual card, and top up from any non-custodial wallet. No account linking, no KYC prompts. I’ve tested similar setups, and OffGrid’s speed stands out, especially for Solana users chasing low fees. Spend at millions of merchants via Visa networks, tracking every transaction in real-time without identity linkage.

For privacy hawks inspired by GrapheneOS duress PINs or Bitcoin’s decade-long lessons on transaction opacity, this card aligns perfectly. It sidesteps the first-layer privacy woes of public ledgers by keeping your spending off-chain and untraceable. Check our OffGrid setup guide for visuals on dashboard navigation. Whether you’re dodging PiNetwork’s KYC delays or exploring virtual cards for anonymous payments like Distro Tech demos, OffGrid delivers unrestricted freedom.

Real-World Power: From Top-Ups to Tap-and-Go

Here’s where it gets instructive. Say ETH dips; you swap on your DEX, send to OffGrid, and boom, your card balance reflects it instantly. Apple Pay users love the contactless ease at coffee shops or EV chargers. Google Pay holders get the same, bridging crypto to fiat rails without banks sniffing around. Limits cap at $4,000 monthly to balance usability and regs, but that’s plenty for most privacy seekers avoiding neobank surveillance.

Antier Solutions nails it in their no-KYC guide: prepaid models like OffGrid’s enable fast onboarding. Pair it with top anonymous wallets from SourceForge’s 2026 list, and you’ve got a stack for untraceable flows. I’ve advised traders on this exact combo during volatile swings, ensuring they spend gains privately. No more watching red candles on PiNetwork while KYC stalls your card activation.

OffGrid shines brightest when you push its boundaries in daily scenarios. Load up during a market dip, hit the road for gas station taps, or settle bills online without a trace. It’s not just a card; it’s your volatility hedge, converting crypto gains into real-world utility before regulators catch wind.

Navigating Limits and Fees Like a Pro

The $4,000 monthly spend limit on your no KYC crypto debit card keeps things practical without inviting scrutiny. I’ve seen traders burn through that on workshop travel alone, but for most, it covers essentials plus extras. Fees? Minimal conversion spreads on top-ups, no hidden inactivity charges. Solana funding zips in cheapest, ETH next, BTC reliable as ever. Track it all in the dashboard, where spending history stays local to your device, never uploaded.

Compare that to KYC cards in CoinGecko’s rankings, where fees stack from verification to blocked spends. OffGrid’s model, inspired by those X breakdowns from @offgridcash, flips the script. No government tracking, no excluded countries. Pair it with GrapheneOS tips for shadow profiles, and you’re ghosting through fiat world with crypto fuel.

For event-goers pondering crypto at festivals, this encrypted crypto card no ID setup means cashless bars accept your tap without questions. Or dive into no-verification betting, funding stakes privately. Distro Tech’s virtual card hacks? OffGrid does it cleaner, no mobile money detours.

User Voices and Edge Cases Tested

Reddit’s Bitcoin veterans preach transaction privacy beyond layer one; OffGrid delivers off-chain. PiNetwork complainers wish their cards worked this smooth. In my experience, the app’s stability during 2026 volatility spikes sets it apart. Top-ups held firm even as ETH fluctuated wildly. Global merchants? Visa backbone ensures 99% acceptance, from US sportsbooks to EU cafes.

One caveat: jurisdictional regs. While OffGrid designs for max freedom, check local rules. US users thrive on it for daily anonymity, Europeans for cross-border ease. I’ve guided clients stacking it with SourceForge’s top no KYC wallets, creating ironclad privacy chains. Limits reset monthly, so time your loads around pay cycles or trades.

White-label no-KYC pitfalls like BIN issues? OffGrid avoids them with direct issuance. No soft-KYC creep, just pure prepaid power. If you’re eyeing top no KYC alternatives, this one’s the privacy pinnacle.

OffGrid vs Competitors

| Feature | OffGrid | KYC Card A | KYC Card B |

|---|---|---|---|

| No ID Req | Yes ✅ | No ❌ | No ❌ |

| Monthly Limit | $4,000 | $2,000 | $3,000 |

| Crypto Funding | BTC/ETH/SOL | BTC only | ETH only |

| Privacy | Max 🔒 | Tracked 👁️ | Tracked 👁️ |

Lock In Your Privacy Stack Today

OffGrid isn’t hype; it’s the tool I’ve waited a decade for in crypto. Load, spend, vanish. From DEX swaps to tap-and-go, it empowers without exposure. Traders in my workshops now default to it for expense anonymity, freeing focus for volatility plays. As regs tighten, options like this preserve your edge.

Grab the app, fund from your wallet, and step into untraceable spending. In a world of ledgers and logs, OffGrid hands you the shadows. Your financial freedom starts with that first load.