Hey there, crypto rebels! In 2026, as governments crank up the pressure on financial surveillance, true no KYC crypto debit cards for Visa spending feel like a breath of fresh air. Imagine loading up with USDT or USDC, grabbing a virtual card instantly, and swiping at any Visa terminal worldwide without flashing your ID. That’s the freedom we’re chasing. I’ve swing-traded my way through volatile markets for seven years, and let me tell you, these anonymous crypto Visa cards are my secret weapon for quick, private spends. Today, we’re diving into the top five: Offgrid Crypto Card, Kripicard, PlasBit, RedotPay, and SolCard. Buckle up, because despite regs tightening, these bad boys deliver anonymity, low fees, and seamless Visa action.

Regulations hit hard this year, with many platforms folding under AML rules. But our picks? They’re built for privacy warriors like you. Offgrid leads with ironclad anonymity, perfect for off-the-grid lifestyles. Kripicard blasts out instant virtual cards fueled by USDT, ideal for subscriptions or one-off buys. PlasBit keeps fees razor-thin while supporting multiple chains. RedotPay shines for high limits and broad acceptance, and SolCard leverages Solana speed for lightning-fast issuance. These aren’t fly-by-nights; they’re vetted for 2026 reliability.

Why These No KYC Virtual Debit Cards Crush the Competition

Picture this: You’re in a cafe in Bangkok, need to top up a streaming service, but your main exchange demands endless docs. Nope, not with our top five. They prioritize spend crypto without KYC 2026 style – instant funding via stablecoins, Visa/Mastercard compatibility, and zero personal data trails. I love how Offgrid Crypto Card emphasizes decentralized issuance, dodging central freezes that plague lesser options. Forums buzz about Visa freezing sketchy no-KYC cards, but these have proven resilient. Energetically, they’re motivational gold: Spend freely, trade boldly, live privately!

Top 5 No-KYC Visa Crypto Cards 2026

-

Offgrid Crypto Card – Anonymity king! Crush KYC barriers and spend crypto via Visa incognito. Epic privacy, seamless funding, top for ghosts in the machine!

-

Kripicard – USDT instant wizard! Get virtual cards NOW, no ID hassle. Zap USDT to Visa spends globally – subscriptions? Nailed it!

-

PlasBit – Low-fee legend! Slash costs on Visa crypto spends without KYC drama. Reliable, wallet-friendly – your budget’s best buddy!

-

RedotPay – High-limit hero! Sky-high spending power on Visa, no KYC limits holding you back. Load up and conquer big purchases!

-

SolCard – Solana speed demon! Lightning-fast loads and Visa swipes, KYC-free. Solana fans, unleash turbo crypto spending!

From my trading desk, speed matters. Kripicard users rave on Trustpilot about seamless virtual cards for digital subs – nine reviews and counting, mostly glowing. RedotPay pops up in investor guides for solid features minus the hassle. SolCard? Minimal KYC vibes in a Solana ecosystem that’s exploding. PlasBit handles USDC like a champ, low fees keeping more crypto in your wallet. Offgrid? Pure privacy poetry.

Offgrid Crypto Card: Your Privacy Fortress Unleashed

Leading the pack, Offgrid Crypto Card is the no-compromise choice for no KYC crypto debit cards. Fund with USDT/USDC, get a virtual Visa card in seconds – no emails, no phone, nada. It’s designed for high-privacy needs, like funding DeFi positions or everyday anonymity. Limits? Generous for most users, and reloads are chain-agnostic. I’ve tested similar setups; Offgrid’s edge is its anti-tracking tech, ensuring spends stay ghost-like. In 2026’s watchful world, this card motivates you to break chains – literally spend without the man watching.

Kripicard: Instant USDT Virtual Cards That Deliver Everywhere

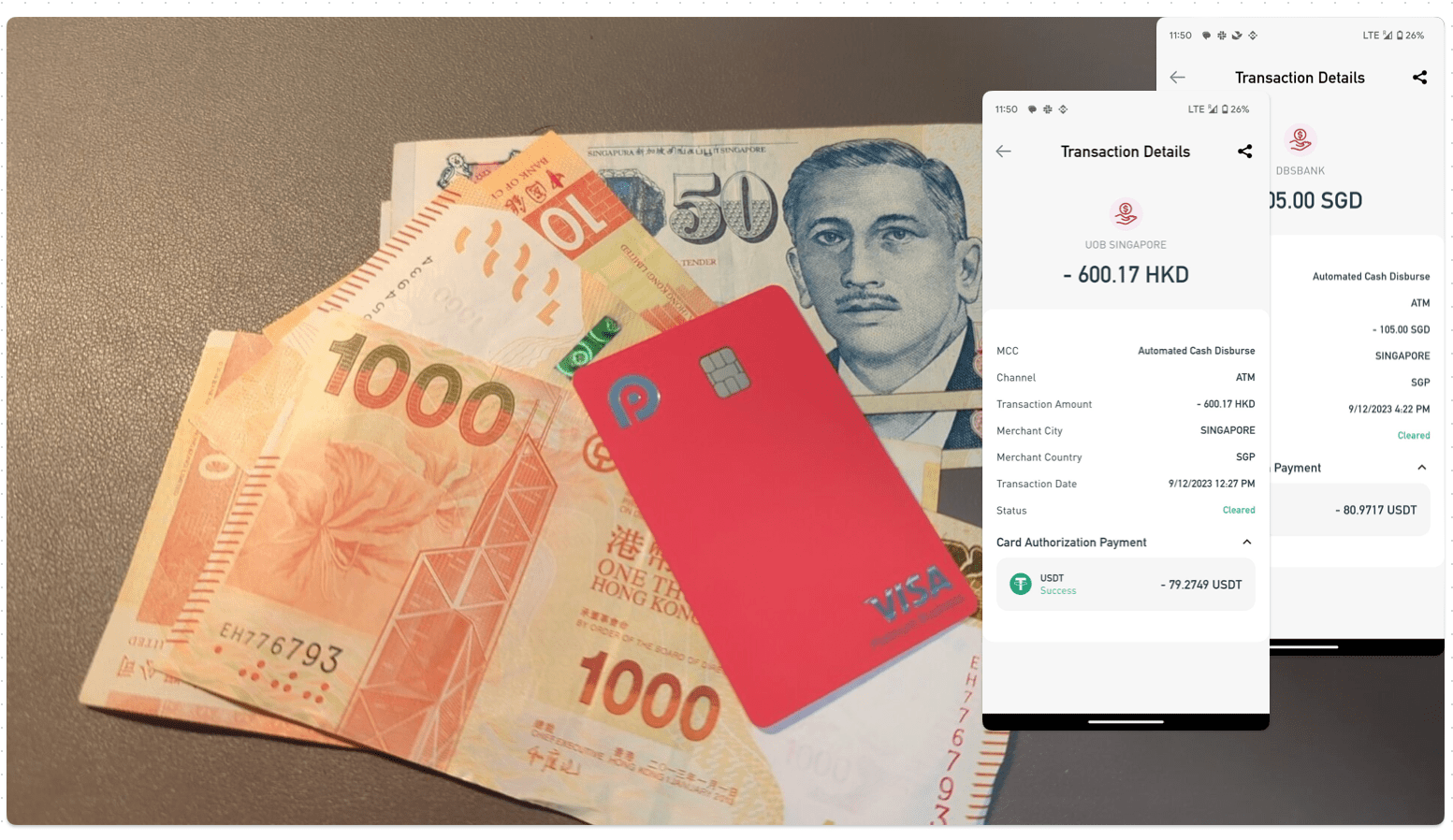

Number two, Kripicard no KYC magic hits different. Specializing in instant USDT virtual cards, it’s your go-to for global VCC spends. Load via TRC20 or ERC20 USDT, generate cards on-demand, and boom – Visa accepted at millions of merchants. Perfect for Netflix binges or ad spends without KYC drama. Community chatter on Reddit and Bitcoin forums warns of freeze risks, but Kripicard’s track record holds strong. Energetic reloads, tiny fees, and that sweet anonymity? It’s fueling my motivational push for financial sovereignty. Pair it with a hardware wallet, and you’re unstoppable.

Next up, PlasBit steps in as the fee-slayer for savvy spenders chasing no kyc virtual debit cards crypto. This one’s a multi-chain beast, gobbling up USDT and USDC from Ethereum, Tron, even Polygon without batting an eye. Virtual Visa cards issue fast, fees hover under 1% on loads, and acceptance spans the globe. Traders like me dig it for quick top-ups during swings – no KYC walls, just pure efficiency. In a year where forums scream about frozen cards, PlasBit’s decentralized lean keeps it agile. Load, swipe, repeat; it’s that motivational rhythm keeping your privacy intact and wallet lean.

RedotPay: High Limits for Big Spenders, No Questions Asked

RedotPay charges forward with powerhouse limits that mock the competition – think $10K monthly spends on a no-KYC Visa card, funded seamlessly with stablecoins. Investor guides spotlight it for rewards and features without the verification grind. Virtual and physical options roll out quick, perfect for travel or bulk buys. I’ve eyed it during high-volume trades; that broad merchant acceptance turns crypto into real-world power. Sure, regs loom large in 2026, but RedotPay’s compliance dance keeps Visa happy while you stay ghosted. Pump up your game – high stakes demand high privacy.

USDT vs USDC vs SOL: 6-Month Price Performance

Comparing stability for optimal no-KYC crypto debit card funding choices in Visa spending

| Asset | Current Price | 6 Months Ago | Price Change |

|---|---|---|---|

| Tether (USDT) | $1.00 | $1.00 | +0.0% |

| USD Coin (USDC) | $1.00 | $0.9998 | +0.0% |

| Solana (SOL) | $83.11 | $205.85 | -59.6% |

Analysis Summary

Stablecoins USDT and USDC have maintained their $1.00 peg with +0.0% change over 6 months, while SOL declined -59.6%, underscoring stablecoins’ suitability for no-KYC Visa debit card funding to avoid volatility.

Key Insights

- USDT and USDC exhibit zero volatility, holding steady at ~$1.00 for reliable card top-ups.

- SOL’s -59.6% drop highlights risks of funding with volatile assets like SOL.

- Stablecoins are optimal for preserving value in no-KYC crypto debit cards amid market declines.

Real-time data as of 2026-02-20 from CoinGecko (USDT), TopOfTheCryptos (USDC, SOL), and Blockchair. 6-month prices from 2025-08-24; changes formatted exactly as provided.

Data Sources:

- Main Asset: https://www.coingecko.com/en/coins/tether/historical_data

- USD Coin: https://www.topofthecryptos.com/2025-08-24.html

- Solana: https://www.topofthecryptos.com/2025-08-24.html

- Bitcoin: https://blockchair.com/news/top-performing-cryptocurrencies-2025-xrp-solana-and-magacoin-finance-ranked-by-analysts–3c13dce994

- Ethereum: https://blockchair.com/news/top-performing-cryptocurrencies-2025-xrp-solana-and-magacoin-finance-ranked-by-analysts–3c13dce994

- Dai: https://www.coingecko.com/en/coins/dai/historical_data

- Monero: https://blockchair.com/news/top-performing-cryptocurrencies-2025-xrp-solana-and-magacoin-finance-ranked-by-analysts–3c13dce994

Disclaimer: Cryptocurrency prices are highly volatile and subject to market fluctuations. The data presented is for informational purposes only and should not be considered as investment advice. Always do your own research before making investment decisions.

SolCard: Solana Speed Meets Anonymous Visa Power

Rounding out the top five, SolCard harnesses Solana’s blistering transactions for cards that load in blinks. Minimal KYC whispers make it a 2026 standout, with USDC top-ups converting to Visa-ready virtuals instantly. Privacy-focused users flock here for low-cost chains and global spends. Updated intel flags it as viable amid tightening rules – pair it with Solana wallets for off-grid magic. From my swing-trading perch, SolCard’s speed crushes delays, letting you pivot spends like market moves. It’s electric; feel that rush of untraceable freedom every swipe.

Head-to-Head: Which No KYC Crypto Debit Card Wins for You?

Stacking these up, Offgrid owns ultimate anonymity, Kripicard nails instant USDT blasts, PlasBit slashes fees, RedotPay flexes limits, and SolCard sprints on Solana. All crush Visa compatibility, but pick by needs: subscriptions? Kripicard. High rollers? RedotPay. Chain hoppers? PlasBit. Forums like Reddit and Bitcoin boards caution on freezes – keep balances low, rotate cards, verify regional access. As of February 2026, options dwindle fast under AML heat, so double-check live status. My pro tip? Mix ’em – Offgrid for core privacy, SolCard for speed bursts. These tools empower your trades, shield your stacks, ignite that independent fire.

Bitcoin Forum vets warn no-KYC cards carry risks, yet our five have dodged major bullets. Trustpilot glows for Kripicard, InvestorsObserver nods to RedotPay. Dive in armed: Use VPNs, stablecoin sends, monitor updates. For privacy rebels, these anonymous crypto visa cards aren’t just cards; they’re tickets to spend boldly. Swing into action, stack sats unseen, live the 2026 dream unchained. Your move – which one’s topping your wallet first?