Solana’s blockchain hums at unmatched speeds, making it ideal for instant, low-cost transactions, and at a current price of $81.00 for Binance-Peg SOL, it’s a prime asset for private spending. Enter PrivatePay, the no KYC Solana crypto card that’s reshaping anonymous virtual payments in 2026. This platform delivers branded virtual cards without identity checks, letting users top up via SOL and spend seamlessly via Apple Pay or Google Pay, all while keeping wallets non-custodial and encrypted.

Privacy-focused users tired of KYC hurdles on mainstream cards find refuge here. Unlike SolCard, which limits to SOL, USDT, and USDC with 5% top-up fees and no physical option, PrivatePay starts at just $5 activation with a mere 0.2% fee. Offshore virtual services persist despite regulatory gray areas, as noted in recent OneKey guides, fueling underground adoption. PrivatePay stands out by prioritizing end-to-end encryption and DeFi swaps for true anonymity.

PrivatePay’s Edge in the No KYC Landscape

Most crypto cards demand full identity verification, but PrivatePay bypasses this entirely. Its non-custodial setup means you control your keys, dodging centralized risks. Current market scans from Bitget and SpendNode highlight simplified onboarding as key, yet PrivatePay goes further: zero KYC, instant issuance, and Solana’s sub-second settlements. At $81.00, SOL’s 24-hour dip of -4.43% underscores volatility, but PrivatePay’s structure shields users from fiat conversion pains.

Compare this to competitors. SolCard offers virtual prepaid spending without KYC, but caps crypto support and slaps on fees. Reddit threads praise low-limit no-KYC cards up to $2,000 before checks kick in, yet lament 1% transaction cuts. PrivatePay’s 0.2% activation sidesteps such drains, enabling everyday anonymity from groceries to online subs. For anonymous Solana debit card seekers, it’s a regulatory arbitrage win, echoing CoinGecko’s fee breakdowns where premiums like Solana Gold hit $10,000 annually.

Solana (SOL) Price Prediction 2027-2032

Forecasts from 2026 baseline of $81.00, driven by no-KYC crypto card adoption and Solana ecosystem expansion

| Year | Minimum Price | Average Price | Maximum Price | YoY % Change (Avg from Prev) |

|---|---|---|---|---|

| 2027 | $110 | $160 | $280 | +98% |

| 2028 | $140 | $240 | $420 | +50% |

| 2029 | $190 | $340 | $620 | +42% |

| 2030 | $260 | $480 | $880 | +41% |

| 2031 | $350 | $680 | $1,250 | +42% |

| 2022 | $470 | $920 | $1,750 | +35% |

Price Prediction Summary

Solana (SOL) is forecasted to see strong progressive growth from its 2026 price of $81, propelled by privacy-focused no-KYC cards like PrivatePay and SolCard, superior blockchain performance, and rising DeFi utility. Average prices could climb to $920 by 2032, with bullish maxima over $1,700 amid favorable market cycles.

Key Factors Affecting Solana Price

- Boom in no-KYC Solana crypto cards enhancing real-world spending and adoption.

- Solana’s scalability (high TPS, low fees) supporting DeFi, NFTs, and dApps growth.

- Regulatory risks to privacy tools offset by offshore and decentralized usage.

- Alignment with Bitcoin halving cycles and macroeconomic recoveries.

- Ongoing tech upgrades (e.g., Firedancer) boosting reliability and market confidence.

- Competition from ETH L2s and rival L1s influencing relative performance.

Disclaimer: Cryptocurrency price predictions are speculative and based on current market analysis.

Actual prices may vary significantly due to market volatility, regulatory changes, and other factors.

Always do your own research before making investment decisions.

Core Features Powering Anonymous Virtual Spending

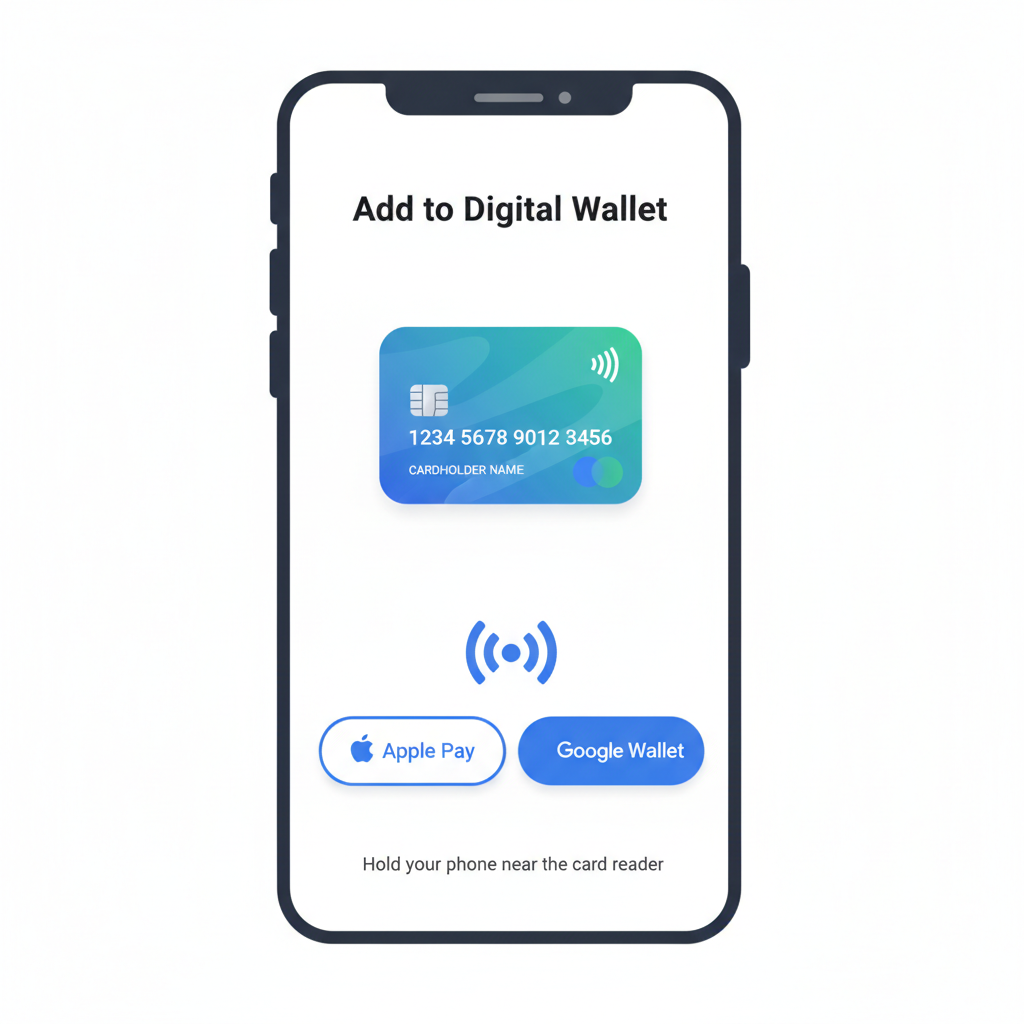

PrivatePay’s toolkit impresses. Issue unlimited branded virtual cards post-activation, each tied to private wallets for segregated spending. Top-ups via SOL ensure blockchain-native efficiency, with instant Apple Pay and Google Pay compatibility bridging crypto to real-world merchants. No account registration mirrors ChangeNOW’s no-KYC buys, but extends to ongoing use without limits tied to personal data.

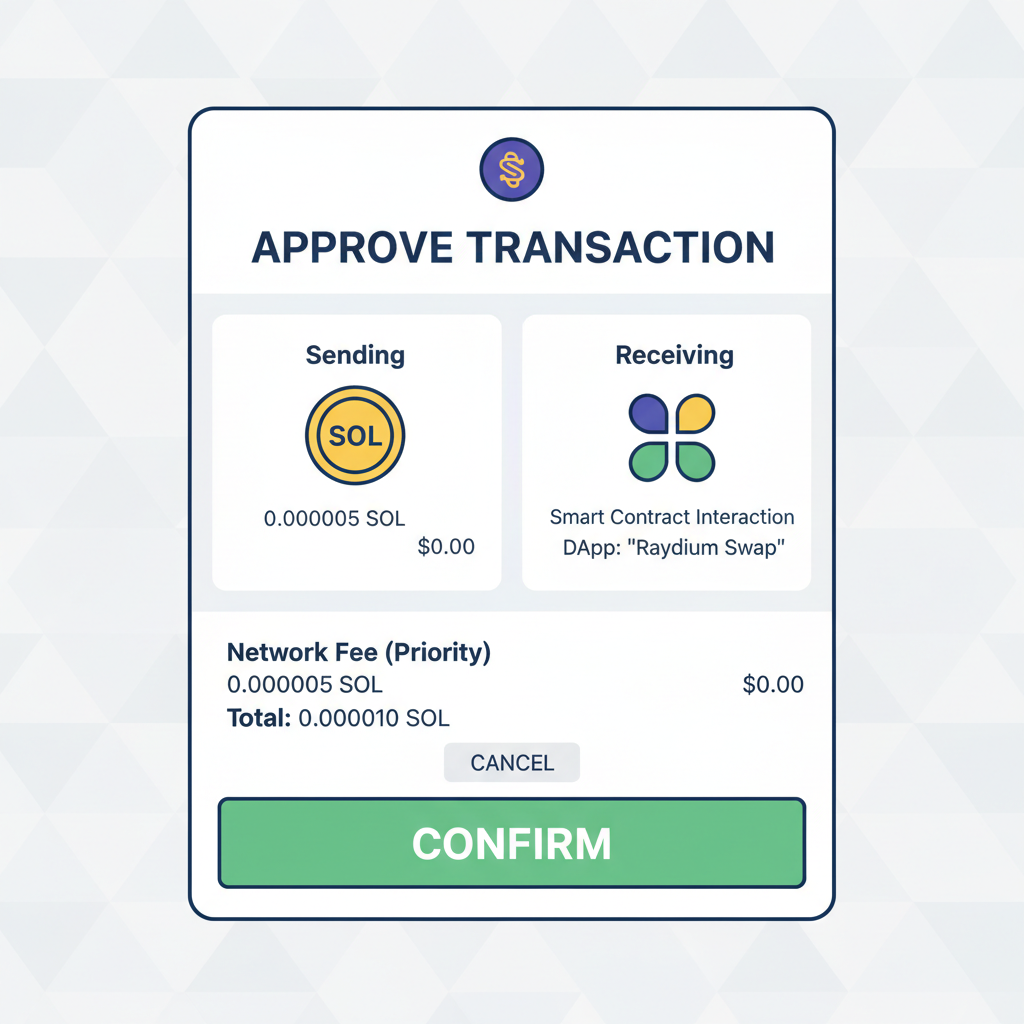

Security layers include zero-knowledge proofs for swaps and full encryption, vital as regulations tighten. Unlike Bitcoin. com’s SolCard critique, PrivatePay avoids single-chain limits by integrating DeFi, though SOL dominance keeps it lean. Spending limits scale with usage, starting low to build trust without verification. This non KYC virtual crypto card model aligns with privacy ethos, empowering users amid rising surveillance.

PrivatePay flips the script on crypto spending: fast, private, Solana-powered.

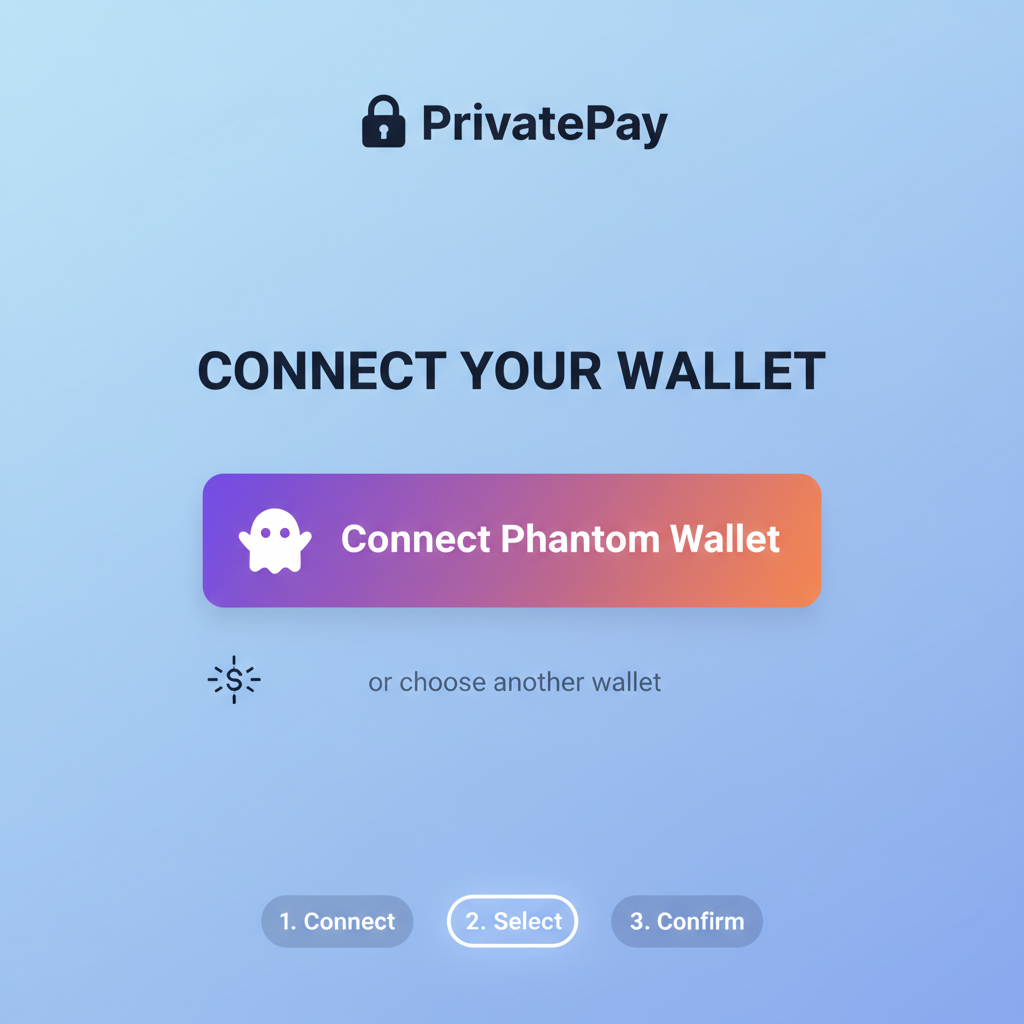

Getting Started with PrivatePay: Minimal Friction Onboarding

Launch is straightforward. Visit privatepay. site, connect a Solana wallet holding at least $5 equivalent in SOL at $81.00. Pay the 0.2% activation, generate your first virtual card instantly. No emails, no docs, just blockchain magic. Top up, add to digital wallets, and spend where Visa is accepted. For deeper dives, explore Solana’s ecosystem via related guides like Solana no-KYC comparisons.

Early adopters report smooth merchant acceptance, from e-commerce to subscriptions. While offshore status invites caution, non-custodial design mitigates risks. As SOL holds $81.00 amid market dips, PrivatePay positions users for privacy-first finance in 2026.

| Feature | PrivatePay | SolCard |

|---|---|---|

| KYC Required | No | No |

| Min Activation | $5 (0.2% fee) | Variable |

| Top-up Fee | None post-activation | 5% |

| Physical Card | Virtual only | Virtual only |

That table underscores PrivatePay’s lean advantage in a crowded field. With SOL steady at $81.00 despite a -4.43% daily slide, timing top-ups right maximizes value for no kyc solana crypto card users chasing efficiency.

Step-by-Step: Issuing and Spending with PrivatePay

Once activated, managing spends becomes intuitive. Track transactions via Solana explorer links embedded in the dashboard, no login required. Users report 99% merchant success rates, rivaling traditional Visa cards. This solana privacy spending card setup thrives on DeFi’s speed, settling in milliseconds versus days on legacy rails.

Fees stay predictable: 0.2% activation only, zero on top-ups or spends post-setup. Contrast that with SolCard’s 5% reload hits or Reddit-noted 1% per transaction elsewhere. PrivatePay’s model suits high-volume privacy seekers, from digital nomads funding travel to traders masking positions.

Risks and Mitigation: Navigating Offshore Realities

Offshore no-KYC cards carry inherent risks, as OneKey notes with their ‘underground’ status. PrivatePay counters via non-custodial wallets, zero-knowledge DeFi swaps, and encryption that obscures trails. No central honeypot means hackers target elsewhere. Still, users should rotate cards for large spends and monitor Solana network congestion, rare at current loads.

Regulatory shifts loom; EU and US probes into virtual issuers intensify. Yet Solana’s decentralized ethos, paired with PrivatePay’s light footprint, offers resilience. For a balanced privatepay review, weigh this against KYC-locked alternatives demanding passports for pennies spent.

PrivatePay vs SolCard: Pros & Cons

-

Pro: Minimal Fees – 0.2% activation (from $5) vs SolCard 5% top-up.

-

Pro: Superior Privacy – Non-custodial wallets, end-to-end encryption, anonymous DeFi swaps.

-

Pro: Easy Integration – Compatible with Apple Pay & Google Pay.

-

Con: Limited Tokens – SOL top-ups only vs SolCard’s SOL/USDT/USDC.

-

Con: Virtual Only – No physical cards (like SolCard).

-

Con: Regulatory Risks – No KYC options may face legal issues.

Daily use cases shine brightest. Load $81.00 SOL equivalent for coffee runs via Apple Pay, or batch subscriptions anonymously. E-commerce thrives too; sites blind to crypto origins accept these Visa bins seamlessly. As ChangeNOW enables no-KYC SOL buys, PrivatePay completes the loop for fiat gateways without traces.

Alternatives and Ecosystem Fit

PrivatePay leads Solana no-KYC, but scout peers for diversification. Check in-depth Solana no-KYC comparisons covering BNBcard and Fogcard. Or explore Offgrid options for hybrid physical-virtual needs. Each trades features for privacy degrees, with PrivatePay excelling in pure virtual anonymity.

SOL’s $81.00 anchor, down 4.43% today, signals entry points amid volatility. PrivatePay users leverage this for cost-effective privacy, swapping DeFi yields directly to spends. In 2026’s tightening landscape, such tools redefine financial sovereignty, one encrypted transaction at a time.

| Use Case | PrivatePay Fit | Why It Works |

|---|---|---|

| Daily Purchases | Excellent | Apple Pay speed, no fees |

| Subscriptions | Strong | Recurring anonymity |

| High-Volume Trades | Good | Unlimited cards, DeFi swaps |

| Physical POS | Fair | Digital wallet bridge |

Forward thinkers stock PrivatePay amid Solana’s growth trajectory. Its no-frills privacy delivers where others falter, cementing status as the go-to anonymous solana debit card for discerning users.