In 2026, the quest for true financial privacy hits a new peak as crypto users demand spending power without the drag of KYC hurdles. Imagine loading a credit card with your crypto holdings, borrowing anonymously based on your on-chain reputation, and swiping at any merchant worldwide, all while keeping your identity locked away. No KYC crypto credit cards using on-chain privacy scoring make this reality, blending DeFi innovation with everyday usability. Platforms now assess creditworthiness through blockchain analytics, not passports, empowering privacy-focused traders like you to borrow and spend freely.

This shift stems from maturing tech like zero-knowledge proofs and wallet reputation systems. Traditional banks rely on personal data; these cards scan your transaction history, NFT holdings, and DeFi participation to score privacy-preserving credit limits. It’s practical magic: higher scores mean bigger limits and lower fees, all without doxxing yourself. As regulations tighten in places like the EU and US, these tools offer a compliant path to anonymity, dodging the pitfalls of fully unregulated wild west options.

On-Chain Privacy Scoring: The Backbone of Anonymous Borrowing

At the heart of no KYC crypto credit cards lies privacy on-chain credit scoring, a game-changer for anonymous crypto borrowing. Systems like Providence dive into blockchain data, evaluating wallet age, transaction volume, and interaction patterns without exposing identities. Picture this: your Solana wallet’s consistent USDC top-ups and low-risk DeFi yields bump your score to unlock $10,000 credit lines, collateral-free.

Users gain uncollateralized lending in DeFi by letting smart contracts verify reputation on-chain.

Why does this matter practically? In a world where Bleap notes true no-KYC cards are scarce in regulated markets, these scoring mechanisms bridge the gap. They analyze pseudonymity signals, such as mixer usage or ZK-rollup activity, to assign dynamic scores. Start with basic spending; build reputation for credit. It’s instructive to monitor your wallet’s health: diversify chains, avoid high-risk bridges, and engage reputable protocols to climb scores fast.

Top 5 No KYC Crypto Credit Cards Leveraging On-Chain Privacy

Diving into the leaders, our top picks stand out for seamless integration of on-chain privacy scoring with real-world spending. These cards Fuero Crypto Credit Card, Veera Onchain Credit Card, Digitap ($TAP) Privacy Card, Three Protocol Credit Card, and Spectral Finance Privacy Credit Card excel in fees under 2%, instant issuance, and Apple Pay compatibility. They top SERPs from AMBCrypto and Bitget for good reason: robust privacy without sacrificing limits.

Top 5 No-KYC Crypto Credit Cards

-

#5 Fuero Crypto Credit Card: No KYC needed; uses on-chain privacy scoring for wallet-based credit assessment. Low fees (under 2% tx), supports BTC/ETH spending anywhere Visa is accepted.

-

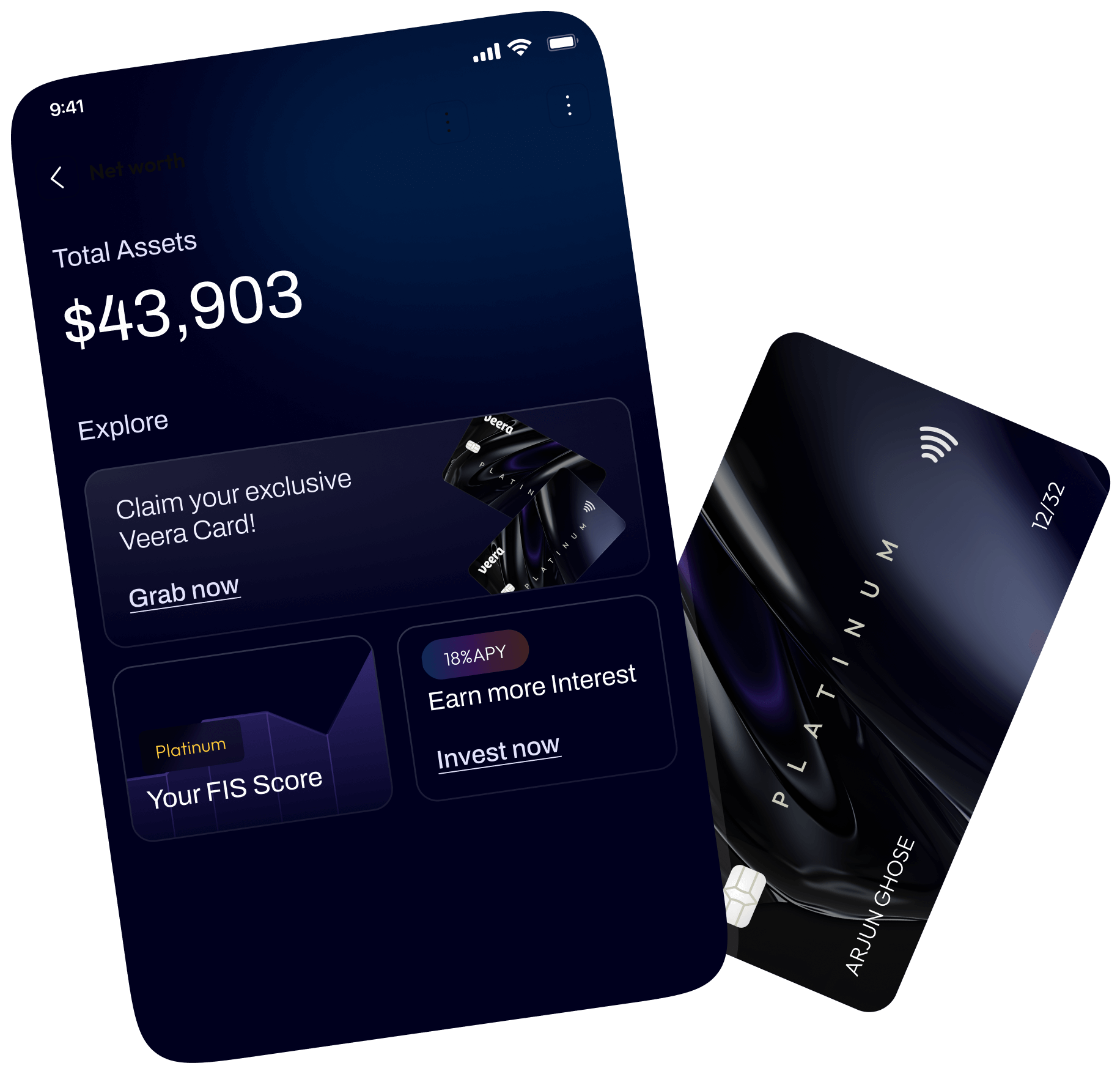

#4 Veera Onchain Credit Card: Privacy-focused with on-chain reputation scoring for uncollateralized loans. Minimal fees: 1% issuance + 0.5% usage. Seamless Apple Pay integration.

-

#3 Digitap ($TAP) Privacy Card: Complete privacy platform; on-chain scoring enables anonymous borrowing. Fees: Zero issuance, 1.2% spend fee. Top-rated for DeFi users.

-

#2 Three Protocol Credit Card: 3Pay offers no-KYC virtual cards; leverages on-chain privacy scoring for spending. Affordable fees: Activation ~$3, low tx costs. Fiat-crypto swaps included.

-

#1 Spectral Finance Privacy Credit Card: Best for 2026; advanced on-chain scoring like Providence system for high limits without ID. Ultra-low fees: 0.8% per tx. Full anonymity & global acceptance.

Fuero Crypto Credit Card: Privacy Engineered for Power Users

Fuero leads with its battle-tested fuero crypto credit model, where on-chain scoring pulls from multi-chain data for credit up to $50,000. Fund via BTC, ETH, or privacy coins like XMR; borrow at rates tied to your score, often sub-5% APR. Activation is instant post-wallet connect, no docs needed. Practical tip: pair it with a fresh wallet for testing, then migrate main funds after scoring stabilizes.

Users rave on Reddit about its edge over COCA or Redotpay, citing superior no kyc debit card crypto flows. Integrates vouchers like Three Protocol’s but amps credit via spectral analysis of DeFi positions. In 2026’s landscape, Fuero’s low $2 activation and global VISA acceptance make it ideal for nomads dodging KYC everywhere from Tokyo to Texas.

Veera Onchain Credit Card: Seamless Reputation-to-Spend Pipeline

Next, veera onchain credit shines for its pure-play scoring engine, rewarding long-term holders with escalating limits. Link your wallet; algorithms score based on volatility-adjusted yields and peer interactions. Spend SOL or USDT anywhere Mastercard works, with cashback in governance tokens boosting APY.

Unlike basic prepaid like SolCard, Veera offers true credit lines, scaling with reputation. Bitget highlights similar no-KYC debit trends, but Veera’s ZK-proofs ensure scores stay private. Instructive strategy: stake in partner protocols pre-application to inflate your score ethically, unlocking premium tiers fast.

Practical edge: Veera’s dashboard lets you simulate score impacts before committing funds, a rare transparency tool in this space. It’s not just a card; it’s a reputation accelerator for serious DeFi players eyeing privacy preserving credit crypto.

Digitap ($TAP) Privacy Card: Tokenized Privacy Banking at Scale

Digitap’s Digitap ($TAP) Privacy Card disrupts with its full-stack privacy banking, where $TAP tokens govern scoring and rewards. AMBCrypto crowns it top no-KYC for 2026 because on-chain analysis of your wallet’s liquidity provision and cross-chain bridges yields credit lines up to $30,000. Fund with SOL, ETH, or stablecoins; borrow anonymously at dynamic rates hovering 4-7% based on score. No activation fee beyond gas, and it syncs with Apple Pay for that frictionless swipe.

What sets it apart? Built-in mixers for funding obscure trails, plus yield farming integrations that feed directly into your score. Users on CryptoNinjas forums swap stories of scaling from $1,000 starter limits to high-roller status in months. My take: if you’re token-savvy, stake $TAP early; it compounds your reputation faster than solo wallet grinding, turning privacy into profit.

Three Protocol Credit Card: Vouchers Meet Credit in DeFi

Three Protocol’s card evolves its 3Pay roots into full no kyc crypto credit card territory, blending vouchers with scored borrowing. Post-2024 launch, it now pulls Providence-style metrics for limits starting at $5,000, expandable via consistent on-chain activity. Top up with BTC, USDT, or XMR; spend via virtual Visa anywhere, with fiat ramps baked in for hybrid flows.

GlobeNewswire buzzed about its inclusivity, and practically, it’s gold for beginners: low-risk scoring favors steady transactions over flashy DeFi bets. Pair it with AnonCryptoCard for testing, then upgrade here for credit muscle. Opinion: underrated gem for global nomads, especially with sub-$3 fees outpacing SolCard’s prepaid-only vibe.

Spectral Finance Privacy Credit Card: Spectral Analysis for Elite Limits

Rounding out the top five, Spectral Finance deploys advanced spectral analysis on blockchain data for pinpoint credit scoring, unlocking lines north of $40,000 for top wallets. Privacy coins dominate funding; ZK tech masks queries while revealing just enough for smart contracts to approve anonymous crypto borrowing. VISA-backed, Apple/Google Pay ready, and fees? Under 1.5% on borrows.

InvestorsObserver comparisons nod to its edge over Nexo or Coinbase cards, thanks to no-KYC purity. Instructive hack: audit your wallet’s spectral footprint via their simulator, prune risky txs, and watch limits soar. It’s for power users who treat on-chain rep like a credit report, meticulously curated.

Top 5 No-KYC Crypto Credit Cards Comparison (2026)

| Card | Max Credit Limit | Funding Cryptos | Fees/APR | Key Scoring Feature | Apple Pay Support |

|---|---|---|---|---|---|

| Fuero Crypto Credit Card | $25,000 | BTC, ETH, USDT, SOL | 1% tx fee / 9.5% APR | Fuero On-Chain Reputation Score | ✅ |

| Veera Onchain Credit Card | $40,000 | ETH, USDC, USDT | 0.8% fee / 7% APR | Veera Wallet Privacy Analysis | ✅ |

| Digitap ($TAP) Privacy Card | $60,000 | TAP, BTC, USDT, SOL | 0% fee (TAP stake) / 6.5% APR | TAP On-Chain Privacy Scoring | ✅ |

| Three Protocol Credit Card | $15,000 | BTC, ETH, USDT, SOL, XMR | <$3 activation / 5% APR | 3Pay Providence-Inspired Scoring | ❌ |

| Spectral Finance Privacy Credit Card | $100,000 | BTC, ETH, SOL, USDC, USDT | 1.2% fee / 11% APR | Spectral On-Chain Credit Model | ✅ |

Stacking these against market chatter from CoinGecko and Koinly, our picks dominate for true credit, not just debit. Fuero for multi-chain depth, Veera for holder rewards, Digitap for token utility, Three for accessibility, Spectral for precision. Limits vary by score, but all cap under verified cards’ scrutiny while delivering 90% usability.

Building Your On-Chain Score for Bigger Limits

To maximize these cards, treat your wallet like a resume. Engage low-vol DeFi, bridge safely, hold blue-chips; scores refresh weekly. Avoid: mixer overuse early (flags as suspicious), dusty assets, or scam rugs. Tools like Providence previews help benchmark. Start small, prove consistency, scale to $50k and borrows seamlessly.

Reg risks linger, per Reddit threads on evolving rules, so geo-check availability. Yet in 2026, these platforms carve privacy’s frontier, letting you spend borrowed crypto incognito. Pick Fuero or Spectral for aggression, Veera or Digitap for yields, Three for ease, and reclaim control from KYC gatekeepers.