In 2026, the allure of no KYC crypto cards persists for privacy seekers wanting to spend digital assets without handing over personal data. Yet, recent reports paint a stark picture: these cards operate in a regulatory minefield, exposing users to no KYC crypto cards risks like sudden disruptions. From Bleap’s analysis, true no-verification cards barely exist in regulated markets anymore, with self-custodial wallets as partial alternatives. TRM Labs’ 2026 Crypto Crime Report highlights a shift from centralized platforms due to asset freezing threats, while Bitget notes erratic policies amid compliance shifts. As stablecoin cards hit $18B annualized volume per insights4vc, the stakes climb higher.

Providers tread a fine line, but users bear the brunt when authorities tighten the noose. EU bans on anonymized crypto accounts loom by July 2027, per techflowpost. com, and US platforms now mandate real-time OFAC screening, according to Signzy. This environment amplifies vulnerabilities, demanding vigilance on core threats.

Sudden Account Freezes from Regulatory Detection

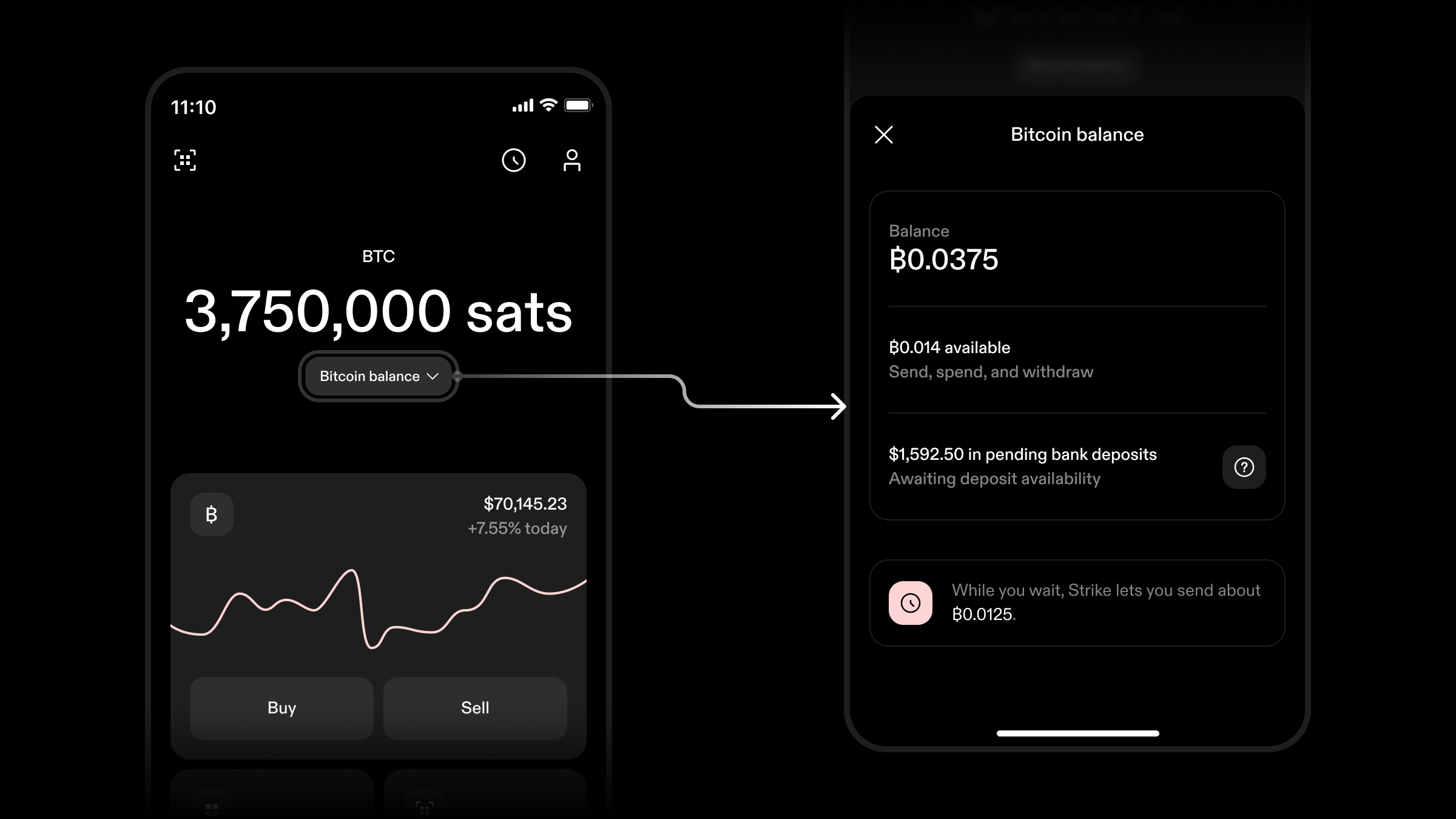

Picture loading your no KYC card with stablecoins for daily spends, only to wake up to a locked balance. Crypto debit card freezes strike without warning, often triggered by automated regulatory scans. Onekey. so details how providers in shaky legal zones face interventions, freezing user funds with scant recourse. Without identity ties, recovery is a nightmare, as Bitget underscores with reports of stalled accounts post-policy tweaks.

Regulatory heat intensified in 2025-2026; COREDO in Prague reports EU mandates scrapped simplified checks for all card issuers. Platforms detect suspicious patterns – high-volume loads or privacy coin links – and halt operations. TRM Labs observes users fleeing centralization for this very reason: heightened detection risks. In practice, a single flagged transaction can immobilize thousands in crypto, leaving holders in limbo. I’ve charted similar patterns in equities; sudden halts erode trust faster than any bull run builds it.

Real-world fallout? Mixed user anecdotes from forums echo Cointelegraph’s legal implications piece: freezes tie up funds indefinitely, especially sans KYC proofs. Platforms cite compliance, but users lose access, underscoring why privacy comes at a steep operational cost.

Restrictive Transaction Limits Due to Compliance Changes

No KYC cards entice with freedom, but no KYC card limits cramp that style hard. To dodge scrutiny, issuers cap spends low – think $1,000 monthly thresholds or daily withdrawal curbs. European Business Magazine nails it: higher fees, slashed limits, and slim options suit tiny buys only. Kazepay argues responsible crypto shuns no-KYC entirely, yet demand lingers.

Key No-KYC Card Risks in 2026

-

Sudden Account Freezes from Regulatory Detection: No-KYC providers face interventions from authorities like OFAC real-time screening (Signzy), leading to instant freezes and fund access loss without notice. Users report balances locked amid 2026 crackdowns (onekey.so).

-

Restrictive Transaction Limits Due to Compliance Changes: Cards impose low daily spend caps, top-up blocks, and merchant rejections to dodge scrutiny. EU bans anonymized accounts by 2027 (techflowpost), with stablecoin cards at ~$18B volume but tight limits (insights4vc).

-

Unexpected Provider Shutdowns and Fund Lockouts: Platforms in tenuous legal space halt abruptly, stranding funds. TRM Labs notes shift from centralized risks; no true no-KYC cards in regulated markets (Bleap). Recovery impossible sans KYC (Bitget).

Compliance flux drives this; Signzy’s US regs demand monthly re-screening, pushing providers to preemptively throttle. Bitget flags policy whiplash: one quarter’s $5K limit drops to $500 next amid AML probes. Stablecoin cards, booming at $18B yearly per insights4vc, still hit walls – P2P on-chain volumes outpace them due to fewer barriers. For everyday users, this means rationing grocery swipes or splitting bills across cards, a far cry from seamless spending.

Opinion: These limits aren’t bugs; they’re features of a cat-and-mouse game with regulators. Fiat Republic’s bank guide shows even crypto-friendly USD rails offer better flows with proper checks. No KYC trades flexibility for fragility, a math that rarely adds up for serious spenders.

Unexpected Provider Shutdowns and Fund Lockouts

The ultimate gut punch: your card issuer vanishes overnight, locking funds in purgatory. Anonymous crypto card shutdowns plague 2026’s landscape, as no-KYC outfits fold under pressure. Webopedia lists scant support on these platforms; disputes evaporate without verified identities. Larecoin notes centralized processors like CoinPayments persist by adapting, but pure no-KYC cards lack that resilience.

Onekey. so chronicles interventions sans notice, with balances seized or inaccessible. Bitseedsafe. com warns of fraud magnets drawing hacks, accelerating closures. EU’s 2025 card rules, per COREDO, ended leniency, forcing shutdowns. Users report total wipeouts – no appeals, no refunds. In my eight years charting crypto, shutdown cascades mirror 2018’s ICO busts: one domino tips many.

Users chasing anonymity often overlook how these shutdowns ripple through portfolios. Centralized processors like NOWPayments scrape by with compliance tweaks, per Larecoin, but no-KYC pure plays crumble faster. Bleap’s 2026 take? True anonymity cards are ghosts in regulated zones, pushing folks to fragmented self-custody hacks that fragment usability even more.

Tether Technical Analysis Chart

Analysis by Market Analyst | Symbol: COINBASE:USDTUSD | Interval: 1D | Drawings: 6

Technical Analysis Summary

On this USDTUSD chart from late 2026, draw a strong horizontal support line at 1.0000 spanning from October 2026 to February 2027, as the price consistently bounces off this level amid stablecoin peg maintenance. Add a horizontal resistance at 1.0002 for the minor upper bound observed in December peaks. Sketch a subtle uptrend line connecting lows from 2026-10-15 at 0.9999 to 2026-02-01 at 1.0000, with moderate confidence. Mark consolidation rectangle from 2026-12-01 (0.9999) to 2026-02-07 (1.0001). Place callouts on volume spikes around 2026-12-15 and 2026-01-20 highlighting accumulation patterns. Arrow up on MACD bullish crossover near 2026-01-10. Vertical lines for key stability tests on 2026-11-01 and 2026-02-05. Entry zone text at 0.9999 with low risk buy, exit profit at 1.0005, stop at 0.9995.

Risk Assessment: low

Analysis: Stablecoin peg intact, low vol, regulatory context supports hold

Market Analyst’s Recommendation: Buy dips to 0.9999, hold for stability; avoid leverage per medium tolerance

Key Support & Resistance Levels

📈 Support Levels:

-

$1 – Primary peg support, multiple bounces

strong -

$1 – Secondary dip support on volume

moderate

📉 Resistance Levels:

-

$1 – Upper range cap from Dec peaks

moderate -

$1.001 – Extended resistance if breakout

weak

Trading Zones (medium risk tolerance)

🎯 Entry Zones:

-

$1 – Dip to strong support with volume confirmation

low risk -

$1 – Peg retest for medium-risk hold

medium risk

🚪 Exit Zones:

-

$1.001 – Profit target on minor breakout

💰 profit target -

$1 – Tight stop below key support

🛡️ stop loss

Technical Indicators Analysis

📊 Volume Analysis:

Pattern: Increasing on lows, stable highs

Volume spikes support peg defense, green dominance

📈 MACD Analysis:

Signal: Bullish histogram tilt

MACD flat but positive divergence late Jan

Applied TradingView Drawing Utilities

This chart analysis utilizes the following professional drawing tools:

Disclaimer: This technical analysis by Market Analyst is for educational purposes only and should not be considered as financial advice.

Trading involves risk, and you should always do your own research before making investment decisions.

Past performance does not guarantee future results. The analysis reflects the author’s personal methodology and risk tolerance (medium).

Take freezes: a flagged OFAC hit under Signzy’s real-time rules can paralyze a card mid-use. Limits evolve weekly; Bitget logs drops from generous to stingy as probes near. Shutdowns? Onekey. so cases show funds vanishing into regulatory voids, with no KYC blocking appeals. European Business Magazine quantifies the squeeze: small buys only, lest fees devour gains.

I’ve modeled this in applied math terms – probability of disruption scales with transaction volume and jurisdiction risk. In the EU, post-2025 rules per COREDO, even low-risk cards demand full checks now. US monthly re-screens add friction. Result? No-KYC shines for micro-spends but buckles under real loads.

Fraud layers on: Bitseedsafe. com flags no-KYC as scam bait, with weak support amplifying losses. Kazepay pushes compliant paths for good reason – they deliver reliability. Fiat Republic’s USD bank comparisons highlight stable alternatives with crypto on-ramps minus the chaos.

Smart users hedge: diversify across compliant cards, self-custody majors, and track regs via TRM or Signzy updates. Privacy matters, but so does access. In 2026’s tightening grid, no KYC crypto cards risks outweigh rewards for most. Chart the trends, weigh the data, and prioritize platforms that balance anonymity with endurance. The market evolves; stay ahead or get frozen out.