Privacy in crypto spending is no longer a fringe concern, it’s a mainstream demand. As regulatory scrutiny intensifies and identity requirements become more invasive, a growing segment of users seeks no-KYC crypto credit cards for 2025. These cards allow you to spend digital assets like Bitcoin, Ethereum, or stablecoins with minimal or no identity verification, preserving your financial autonomy while staying within legal boundaries.

Why Choose No-KYC Crypto Credit Cards in 2025?

The appeal of anonymous crypto cards is simple: they let you access the global payments network without exposing your identity at every turn. Whether you’re a privacy advocate, an expat, or simply value discretion, these products offer flexibility and peace of mind. In 2025, the best options combine ease of use with robust security features and compatibility with major payment platforms like Apple Pay and Google Pay.

It’s important to note that legality depends on your jurisdiction. Most leading providers ensure their offerings are compliant where available, but always confirm local regulations before use. Here’s our expert rundown of the ten best no-KYC crypto credit cards for privacy-centric users this year.

The Top 10 No-KYC Crypto Credit Cards for Private Spending

Top 10 No-KYC Crypto Credit Cards for 2025

-

Midnight Blue Card (Crypto.com): Crypto.com’s entry-level card offers a no-staking, no-KYC tier for basic spending. No identity verification required for the Midnight Blue tier, making it ideal for privacy-focused users. Accepted globally via Visa network.

-

Wirex Anonymous Virtual Card: Wirex provides a virtual card option that allows users to spend crypto with minimal KYC. Anonymous tier available for small limits and online purchases, supporting Bitcoin, Ethereum, and more.

-

Bitpay Prepaid Mastercard (No-KYC Tier): Bitpay offers a no-KYC tier on its prepaid Mastercard, letting users spend crypto up to a certain threshold without full identity checks. Supports BTC, ETH, and major stablecoins.

-

SpectroCoin Anonymous Crypto Card: SpectroCoin’s anonymous card tier enables users to transact with no ID verification for lower limits. Wide crypto support and global acceptance.

-

Uquid Virtual Visa (No-KYC Option): Uquid’s virtual Visa card offers a no-KYC option for small balances, letting users spend crypto privately online. Compatible with major cryptocurrencies.

-

CoinsPaid Crypto Card (Anonymous Tier): CoinsPaid features an anonymous card tier for users who want to spend crypto without submitting personal documents. Works with BTC, ETH, USDT, and more.

-

Advcash Crypto Card (No Verification Option): Advcash issues crypto cards with a no-verification option for limited usage. Users can spend Bitcoin and other cryptos with minimal onboarding.

-

Paycent Crypto Card (No-KYC Tier): Paycent’s card includes a no-KYC tier for basic spending, supporting multiple cryptocurrencies and fiat conversions with minimal requirements.

-

Plasbit Anonymous Crypto Card: Plasbit offers an anonymous crypto card option for privacy-first users, allowing spending without identity checks up to certain limits.

-

Mistertango Crypto Card (No-KYC Option): Mistertango provides a crypto card with a no-KYC option for low-volume users, supporting seamless crypto-to-fiat transactions and broad merchant acceptance.

1. Midnight Blue Card (Crypto. com)

Midnight Blue, from Crypto. com, stands out as a straightforward entry point for those seeking a basic, no-frills card without staking or KYC headaches. While it doesn’t offer cashback rewards like premium tiers, its lack of staking and verification requirements make it ideal for everyday private spending. The card is widely accepted and integrates seamlessly with mobile wallets.

2. Wirex Anonymous Virtual Card

The Wirex Anonymous Virtual Card provides an easy way to spend cryptocurrencies online without submitting ID documents. Wirex’s anonymous tier supports multiple digital assets and enables instant virtual card issuance, perfect for online shopping or subscriptions where privacy matters most.

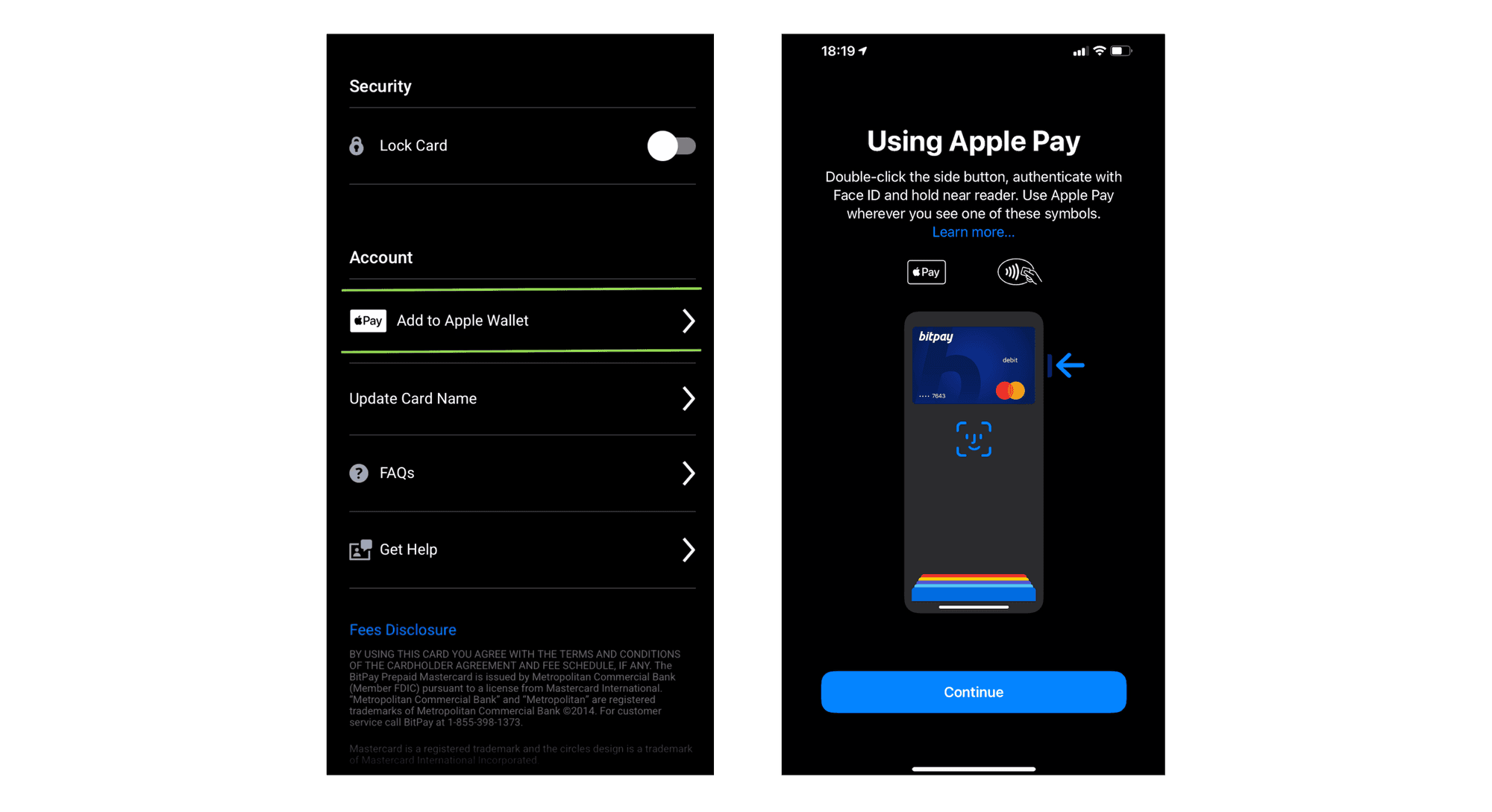

3. Bitpay Prepaid Mastercard (No-KYC Tier)

Bitpay’s Prepaid Mastercard, when used at its no-KYC level, offers robust privacy while supporting direct spending in BTC and other supported coins. The onboarding process is streamlined: basic details only, no uploads required at this tier. It’s especially popular among US-based users looking for low fees and broad merchant acceptance.

4. SpectroCoin Anonymous Crypto Card

SpectroCoin’s Anonymous Crypto Card lets users load funds via BTC or ETH without submitting personal documents at lower limits. This makes it suitable for smaller purchases or travel expenses where anonymity is paramount but spending needs remain modest.

No Identity Verification? What You Need to Know

No-KYC doesn’t mean lawless; these products operate within legal frameworks but minimize personal data collection by designating certain tiers as low risk or by capping spending amounts below regulatory thresholds. For example, SpectroCoin and Bitpay both offer anonymous tiers with lower daily limits but higher privacy guarantees.

This approach allows you to enjoy many benefits of traditional credit cards, including contactless payments and global acceptance, while keeping your name off centralized databases wherever possible.

Diving Deeper: Uquid Virtual Visa and CoinsPaid Crypto Card

The Uquid Virtual Visa (No-KYC Option) is another favorite among privacy seekers thanks to its fast setup process and support for dozens of cryptocurrencies beyond just BTC or ETH. Similarly, CoinsPaid’s Anonymous Tier lets you generate disposable virtual cards funded directly from your wallet, ideal for one-off purchases or services that require extra discretion.

If you’re comparing features side-by-side across all ten options, including Advcash Crypto Card (No Verification Option), Paycent Crypto Card (No-KYC Tier), Plasbit Anonymous Crypto Card, and Mistertango Crypto Card (No-KYC Option) – focus on factors such as:

- KYC-free onboarding steps

- Total monthly/annual fees

- Currencies supported (BTC/ETH/stablecoins/altcoins)

- Spending caps per tier

- Mobile wallet compatibility

For those who measure every step for privacy and legality, the remaining cards on our list each bring something unique to the table. Let’s take a closer look at how these no-KYC crypto credit cards compare in real-world use, fees, and supported features.

5. Advcash Crypto Card (No Verification Option)

Advcash offers a crypto card solution that lets you bypass identity verification for lower spending tiers. It’s especially popular with freelancers and international users who want to move funds quickly without red tape. Advcash supports multiple fiat and crypto top-ups, making it a flexible addition for those managing cross-border payments or remittances.

6. Paycent Crypto Card (No-KYC Tier)

Paycent stands out with its hybrid approach: users can select a no-KYC tier for smaller purchases or upgrade later if higher limits are needed. The card is accepted globally and supports both online and in-store transactions, giving users the ability to spend anonymously almost anywhere Visa or Mastercard are taken.

7. Plasbit Anonymous Crypto Card

The Plasbit Anonymous Crypto Card is designed from the ground up for privacy-first individuals. With no identity checks required at issuance, you can fund your card using Bitcoin or stablecoins and enjoy fast settlement times. Its virtual format is ideal for online shopping, subscriptions, or even digital advertising spend where discretion is crucial.

8. Mistertango Crypto Card (No-KYC Option)

Mistertango provides an anonymous card option that integrates with both mobile wallets and traditional POS systems. The onboarding process is minimal: just an email address and basic details suffice for their no-KYC tier. Mistertango’s focus on user autonomy makes it a go-to choice for those who prioritize both privacy and convenience in their daily financial lives.

Comparing Features: Finding Your Best Fit

The best no-KYC crypto credit cards of 2025 aren’t just about anonymity, they’re about practical usability in your day-to-day life. Here’s what sets them apart:

Top 10 No-KYC Crypto Credit Cards Compared (2025)

-

Midnight Blue Card (Crypto.com): • Spending Limit: Up to $10,000/month (no staking required) • Supported Cryptos: BTC, ETH, CRO, USDT, and more • Fees: No annual fee, standard network conversion fees • Wallet Compatibility: Crypto.com App, Apple Pay, Google Pay

-

Wirex Anonymous Virtual Card: • Spending Limit: Up to $2,500/month (no KYC tier) • Supported Cryptos: BTC, ETH, LTC, XRP, WXT, USDT • Fees: $1.50 issuance, 1% top-up fee • Wallet Compatibility: Wirex Wallet, Apple Pay, Google Pay

-

Bitpay Prepaid Mastercard (No-KYC Tier): • Spending Limit: Up to $1,000/day (no KYC tier) • Supported Cryptos: BTC, BCH, ETH, DOGE, USDC, DAI, LTC • Fees: $10 issuance, no monthly fee, 3% foreign transaction fee • Wallet Compatibility: Bitpay Wallet, Apple Pay, Google Pay

-

SpectroCoin Anonymous Crypto Card: • Spending Limit: Up to €2,500/month (anonymous tier) • Supported Cryptos: BTC, ETH, USDT, XEM, DASH • Fees: €9 issuance, €1.50 monthly, 1% load fee • Wallet Compatibility: SpectroCoin Wallet, mobile wallets

-

Uquid Virtual Visa (No-KYC Option): • Spending Limit: Up to $5,000/month (no KYC) • Supported Cryptos: BTC, ETH, USDT, BNB, LTC, DASH • Fees: $16.99 issuance, $1.00 monthly, 3% foreign transaction fee • Wallet Compatibility: Uquid Wallet, browser wallets

-

CoinsPaid Crypto Card (Anonymous Tier): • Spending Limit: Up to €1,000/month (anonymous) • Supported Cryptos: BTC, ETH, USDT, BCH, LTC • Fees: €5 issuance, €1.50 monthly, 1.5% top-up fee • Wallet Compatibility: CoinsPaid Wallet, Apple Pay, Google Pay

-

Advcash Crypto Card (No Verification Option): • Spending Limit: Up to $2,500/month (no verification) • Supported Cryptos: BTC, ETH, USDT, BCH, LTC, XRP • Fees: $5 issuance, $1.00 monthly, 2% load fee • Wallet Compatibility: Advcash Wallet, browser wallets

-

Paycent Crypto Card (No-KYC Tier): • Spending Limit: Up to $1,500/month (no KYC) • Supported Cryptos: BTC, ETH, LTC, DASH, PYN • Fees: $10 issuance, $1.50 monthly, 1.5% transaction fee • Wallet Compatibility: Paycent Wallet, mobile wallets

-

Plasbit Anonymous Crypto Card: • Spending Limit: Up to $3,000/month (anonymous tier) • Supported Cryptos: BTC, ETH, USDT, BNB, LTC • Fees: $15 issuance, $1.50 monthly, 2% load fee • Wallet Compatibility: Plasbit Wallet, Apple Pay, Google Pay

-

Mistertango Crypto Card (No-KYC Option): • Spending Limit: Up to €1,000/month (no KYC) • Supported Cryptos: BTC, ETH, USDT, LTC • Fees: €9.99 issuance, €1.00 monthly, 1.5% top-up fee • Wallet Compatibility: Mistertango Wallet, browser wallets

If you value low fees, the Bitpay Prepaid Mastercard (No-KYC Tier) often comes out ahead; if wallet compatibility is key, Midnight Blue or Wirex may be your best bet due to seamless Apple Pay/Google Pay integration. For wider asset support, Uquid Virtual Visa leads with dozens of altcoins available beyond BTC or ETH.

Legal Compliance: Privacy Without Compromise

The landscape of legal no-KYC crypto cards in 2025 has matured significantly compared to previous years. Responsible providers now structure their offerings so that low-limit tiers operate below regulatory thresholds, meaning you can spend privately without risking compliance issues in most jurisdictions.

This careful balance allows users to maintain autonomy over their funds while still participating fully in the global economy. Remember: always check local laws before ordering any card from this list, regulations can change rapidly as governments respond to evolving technology.

The Future of Private Crypto Spending

The drive toward privacy-focused financial tools shows no sign of slowing down as digital assets become mainstream payment options worldwide. Whether you choose Midnight Blue for simplicity, Plasbit for pure anonymity, or Uquid for multi-asset versatility, today’s best no identity verification crypto cards grant more control than ever before, without sacrificing legal peace of mind.

If you’re ready to take your next step toward true financial privacy, or simply want more options beyond traditional banks, explore our full breakdowns at 10 Best No KYC Crypto Credit Cards for True Financial Privacy in 2025. As always, stay vigilant about evolving regulations and choose only reputable providers committed to transparency and user protection.