Instant approval, no-KYC crypto credit cards are the holy grail for privacy-focused users in 2024. As regulatory crackdowns ramp up and MiCA reshapes the European landscape, true anonymity is rare. But if you want speed, minimal friction, and immediate spending power, a handful of cards still fit the bill. Here’s how the top contenders stack up right now.

Why Instant Approval No-KYC Crypto Cards Matter in 2024

The crypto card market has shifted: most major providers now demand at least some identity checks, often citing compliance with new EU rules. Yet demand for fast, private spending hasn’t slowed down. The best instant approval crypto credit cards let you skip tedious document uploads and get spending in minutes – no invasive KYC roadblocks, no waiting for manual review.

But don’t be fooled: not all “no-KYC” claims are created equal. Many cards tout minimal verification but sneak in ID checks at higher limits or during suspicious activity reviews. That’s why we’ve curated this list of five options that are truly privacy-forward and offer real instant access in 2024.

Top 5 Instant Approval No-KYC Crypto Credit Cards: 2024 Comparison

Top 5 Instant Approval No-KYC Crypto Credit Cards (2024)

-

Bitget Wallet Virtual Card: Instant card activation with no document verification required. Supports a wide range of cryptocurrencies including Bitcoin, Ethereum, and USDT. Privacy: No KYC for issuance. Approval Speed: Immediate. Fees: Low issuance and transaction fees. Supported Cryptos: BTC, ETH, USDT, and more.

-

YooCard (by YooMoney): Virtual prepaid card offering quick setup and minimal verification. Privacy: Basic info only, no full KYC for low limits. Approval Speed: Issued within minutes. Fees: Competitive; varies by region. Supported Cryptos: Indirect support via exchange integration (BTC, ETH, etc.).

-

CryptoPay Prepaid Virtual Visa: Fast onboarding with optional KYC for higher limits. Privacy: No KYC for basic usage. Approval Speed: Instant virtual card issuance. Fees: Transparent, low monthly and transaction fees. Supported Cryptos: BTC, ETH, LTC, XRP, and more.

-

CoinsPaid Crypto Card: Seamless crypto spending with minimal verification. Privacy: No KYC for small transactions. Approval Speed: Card issued instantly. Fees: Low maintenance and conversion fees. Supported Cryptos: BTC, ETH, USDT, and other major coins.

-

Advcash Crypto Card: Instant virtual and physical card issuance with basic info required. Privacy: No KYC for limited usage. Approval Speed: Immediate activation. Fees: Low issuance and service fees. Supported Cryptos: BTC, ETH, BCH, LTC, USDT, and more.

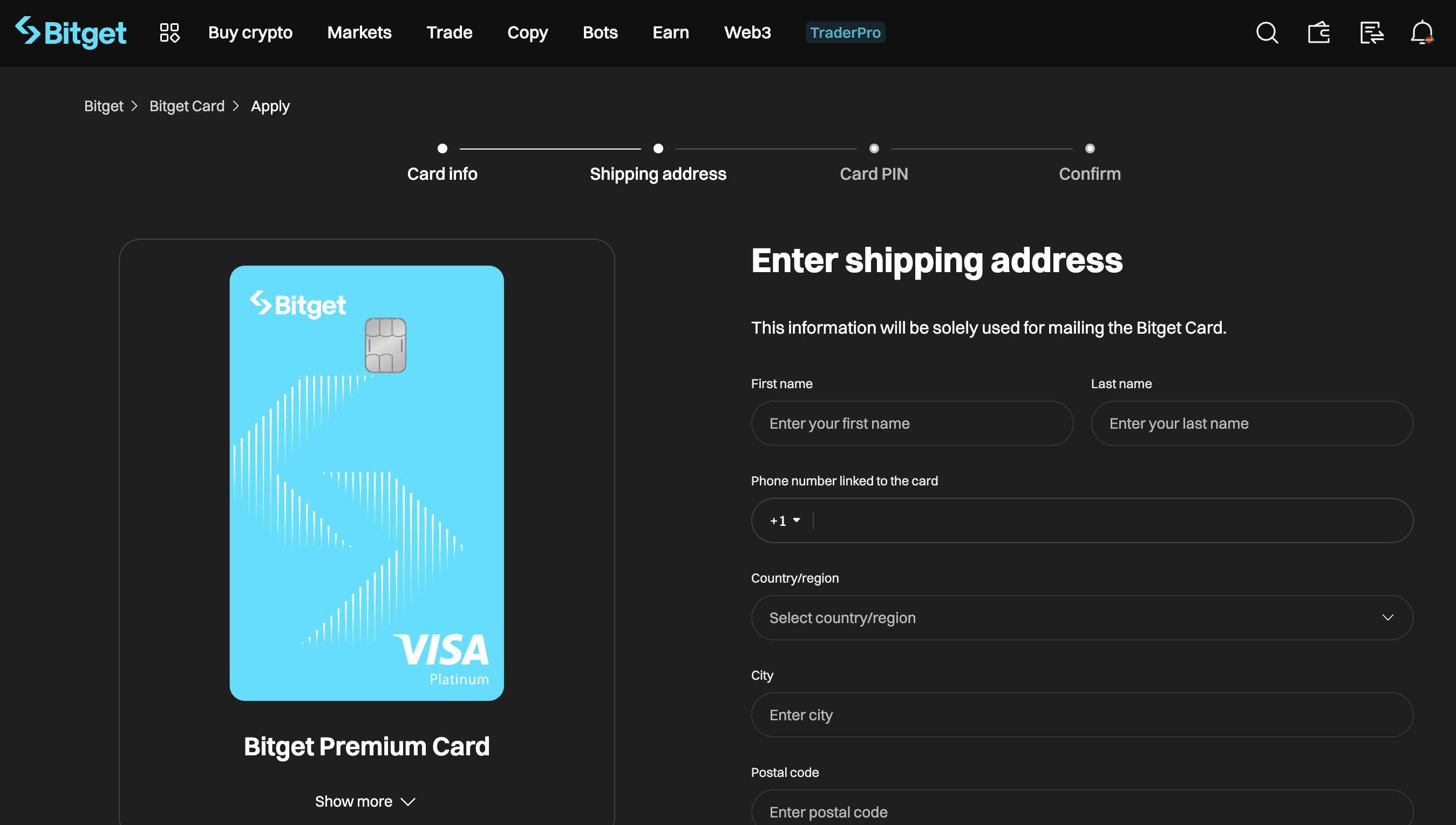

Bitget Wallet Virtual Card: Privacy at Lightning Speed

Bitget Wallet’s virtual card is built for those who refuse to wait. With instant activation, you can go from sign-up to spend-ready in under five minutes – no document uploads required. This card is especially popular among traders who need to move fast between exchanges or cash out without leaving a paper trail.

You fund your card directly with BTC or USDT from your Bitget Wallet balance and start using it online or through Apple Pay/Google Pay instantly. There’s no staking requirement or hidden compliance traps lurking after you’ve onboarded. For the latest on how Bitget achieves this seamless experience, check out their own breakdown here.

YooCard (by YooMoney): Russian-Backed Flexibility

If you want a card that works across Russian-friendly merchants without KYC headaches, YooCard by YooMoney is a strong pick. While it’s not as global as some rivals, activation is nearly instant – just basic info like email and phone number gets you started. You can top up with crypto via third-party OTC desks or direct P2P swaps inside some wallets.

The main draw? Wide acceptance across CIS countries and low fees for domestic transactions. International use is possible but comes with higher FX conversion charges.

CryptoPay Prepaid Virtual Visa: Spend Globally Without Borders

CryptoPay’s Prepaid Virtual Visa stands out for its international reach – available to users in over 150 countries with almost zero onboarding friction. No documents needed unless you plan to spend above modest daily limits (usually $1,000-$1,500). Fund directly via Bitcoin or Ethereum and start shopping online right away.

This card is especially popular among digital nomads and freelancers who need reliable access without risking their privacy on centralized exchanges or banks.

For those who value speed and discretion, CryptoPay’s virtual Visa is a game-changer. You get a usable card number, CVV, and expiry instantly after funding, no long waits, no compliance calls. Just pure, frictionless crypto spending. The only watch-out: if you plan on high-volume transactions or physical withdrawals, you may eventually hit soft KYC triggers. But for most users staying under the radar, this remains one of the fastest ways to convert crypto to fiat for everyday purchases.

CoinsPaid Crypto Card: Business-Grade Privacy

CoinsPaid has carved out a niche among business users and high-frequency traders who need instant access and robust privacy controls. Their crypto card is issued with minimal KYC, typically just an email and phone number, letting you fund with BTC, ETH, USDT, or dozens of other major coins. Approval is near-instant for most users.

What sets CoinsPaid apart is its focus on seamless integration with merchant solutions and bulk payouts. If you’re running payroll in crypto or need to issue cards to your team without exposing identities, this platform delivers. Daily limits are generous compared to most no-KYC options; just stay mindful of jurisdictional restrictions as MiCA rules bite across Europe.

Advcash Crypto Card: The Veteran’s Choice

Advcash is one of the oldest names in privacy-centric payments, and their crypto card still leads the pack for instant approval with minimal verification. The onboarding process is lightning-fast: register with basic info, load up your balance via BTC/ETH/USDT (or even direct fiat from certain exchanges), and your virtual card details appear in seconds.

Advcash supports both virtual and plastic cards, but it’s the virtual option that shines for privacy hawks. Use it for online shopping or quick withdrawals at ATMs worldwide (subject to local limits). Fees are competitive, typically around $10 per issuance plus a 1% transaction fee, making it attractive for both casual spenders and power users alike.

Key Risks and Realities: No-KYC Isn’t Always Forever

No-KYC doesn’t mean zero oversight forever. Most instant approval cards have built-in risk engines: sudden spikes in spending or flagged transactions can trigger manual reviews or temporary holds. And as global regulations tighten, especially post-MiCA, you should expect more providers to quietly raise their KYC barriers over time.

If absolute anonymity is your top priority, keep your spending modest and avoid linking cards directly to centralized exchange accounts or personal emails tied to your identity. Consider using non-custodial wallets when funding these cards for an extra layer of separation.

How To Choose Your Instant Approval No-KYC Crypto Card

The best card for you will depend on where you live, which cryptos you hold, how much you plan to spend monthly, and how much risk you’re willing to take on the compliance front. Here’s a rapid-fire checklist:

- Bitget Wallet Virtual Card: Best for global speed demons who want pure digital privacy.

- YooCard: Ideal if your life runs through Russia/CIS markets.

- CryptoPay Prepaid Visa: The go-to choice for nomads needing broad international coverage.

- CoinsPaid: Built for business use cases and higher volume needs.

- Advcash: Perfect blend of legacy trust and instant activation, great all-rounder.

The bottom line? Speed is security, but only if you understand the trade-offs between privacy and evolving regulations. Stay nimble by using cards that match your risk appetite today; don’t assume that “no-KYC” will last forever as rules keep shifting globally.