For privacy-focused crypto users, the search for a no-KYC crypto credit card with the lowest fees is more relevant than ever. As regulatory scrutiny increases and financial surveillance grows, these cards offer a unique blend of anonymity and freedom. Yet, with dozens of options on the market, pinpointing the cheapest no-KYC crypto credit card in 2025 requires a careful look at transaction costs, reload fees, and hidden charges.

No-KYC Crypto Card Fees: What Matters Most?

The core appeal of no-KYC cards is clear: privacy without paperwork. But cost structures vary widely. Some cards charge flat activation or issuance fees, while others apply percentage-based reload or foreign exchange (FX) fees. For long-term users or frequent spenders, even small differences can add up quickly.

Let’s break down the six most cost-effective no-KYC crypto credit cards for 2025 by their headline fees and features:

6 Most Cost-Effective No-KYC Crypto Credit Cards (2025)

-

Bybit Card: No annual fee, 0.5% foreign exchange fee (on top of Mastercard’s rate), and no hidden charges. Widely accepted and ideal for international travelers seeking low ongoing costs without KYC requirements.

-

Bitget Card: Features a 1.7% comprehensive fee, with zero top-up or monthly charges. This card stands out for its low overall cost structure and straightforward fee policy, making it one of the most affordable no-KYC options.

-

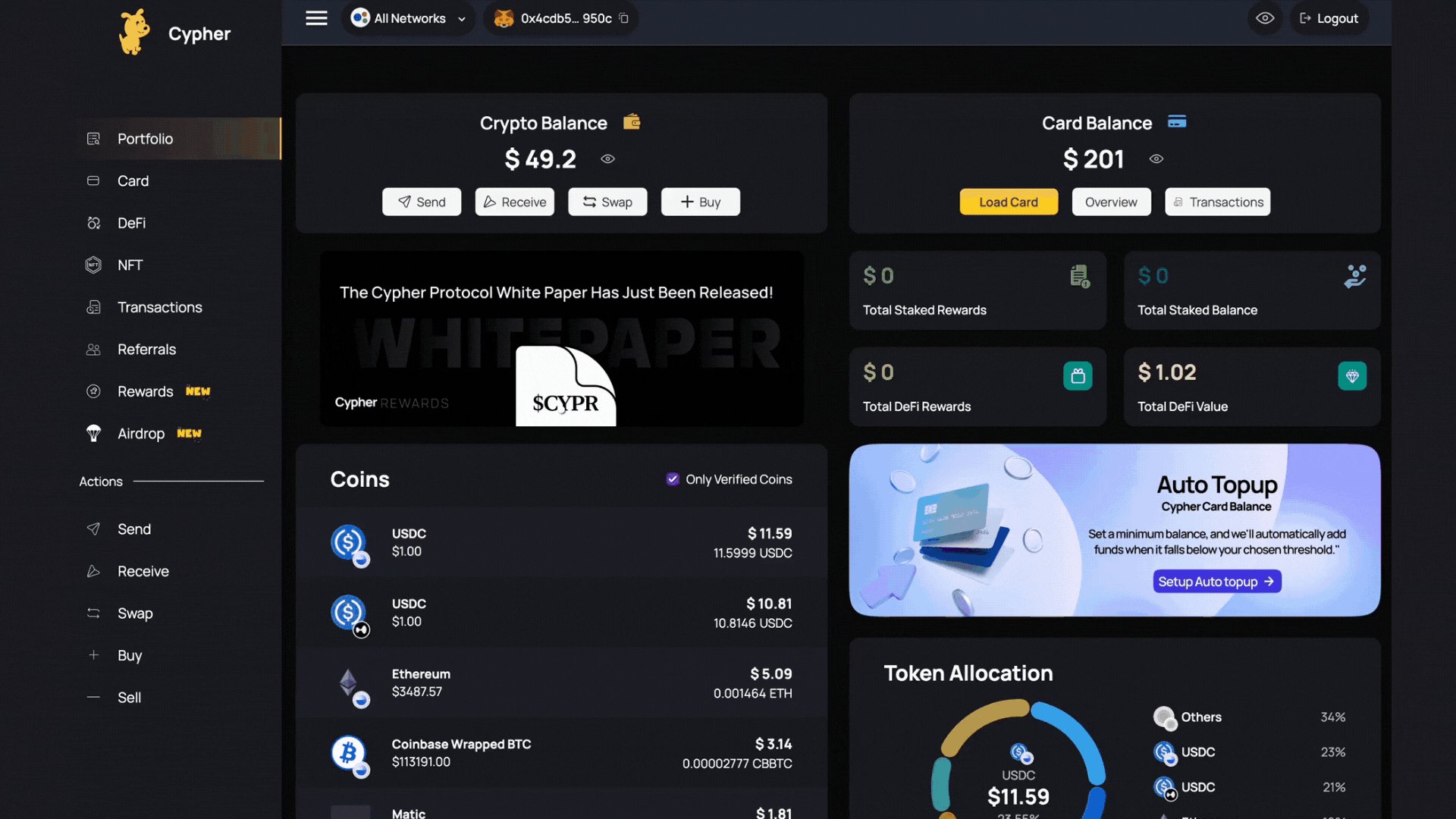

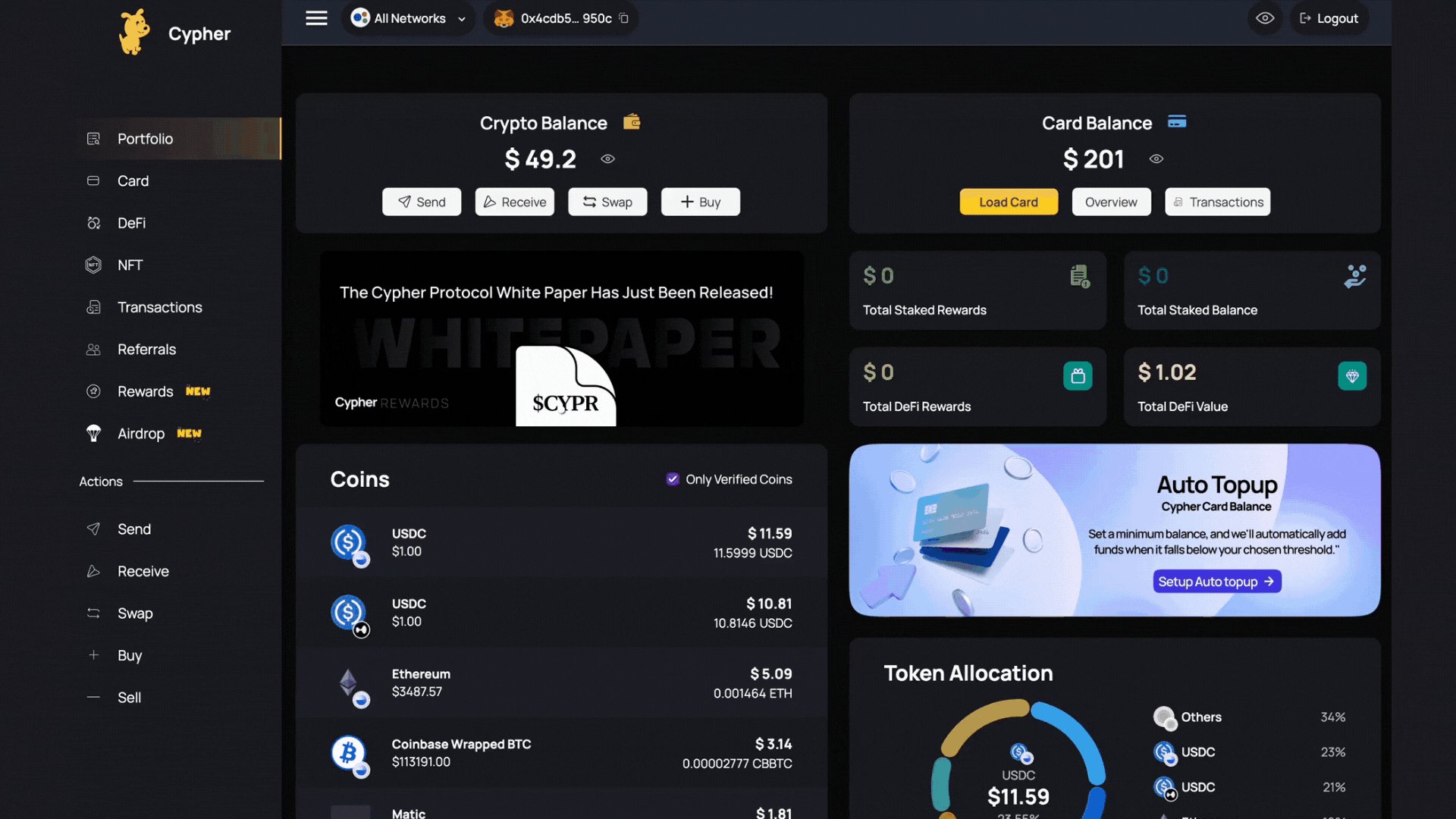

Cypher Card: A non-custodial crypto card with minimal transaction fees and no KYC required. Users retain full control of their funds, and only network fees apply, ensuring maximum privacy and cost efficiency.

-

Wirex Anonymous Crypto Card: Offers no monthly or annual fees and low FX rates. Designed for privacy-focused users, this card allows for anonymous spending and competitive transaction costs.

-

Paycent Crypto Debit Card: Allows no KYC for low spending limits and provides competitive transaction fees. Suitable for users who prioritize privacy and want to avoid high maintenance charges.

-

Solayer Non-Custodial Card: Requires no KYC and charges transparent network fees only. This card is ideal for those who want complete control over their crypto and spending, with costs limited to blockchain transaction fees.

Detailed Fee Comparison: Top Six No-KYC Crypto Credit Cards (2025)

| Card | Main Fees | KYC Required? | Unique Feature |

|---|---|---|---|

| Bybit Card | No annual fee, 0.5% FX fee, no hidden charges | No | Straightforward pricing; Mastercard network |

| Bitget Card | 1.7% comprehensive fee; zero top-up/monthly fees | No | Lowest all-in fee structure on market in 2025 (Bitget Wallet source) |

| Cypher Card | Minimal transaction fees; non-custodial model | No KYC ever | User holds private keys; maximum privacy (Defiprime source) |

| Wirex Anonymous Crypto Card | No monthly/annual fees; low FX rates (varies by region) | No for low limits | User-friendly app integration; competitive for travel use |

| Paycent Crypto Debit Card | No KYC for low limits; competitive transaction fees (varies) | No for basic tier | Suits infrequent spenders or those with modest usage |

| Solayer Non-Custodial Card | Transparent network fees only (blockchain gas); no other charges | No KYC ever | Pure non-custodial model; advanced privacy features |

The Standouts: Lowest-Cost No-KYC Crypto Credit Cards Explained

The Bybit Card, with its zero annual fee and only a 0.5% FX surcharge atop Mastercard’s rate, stands out as a favorite among global travelers and digital nomads who value predictable costs and broad acceptance. There are truly “no hidden charges, ” making it easy to estimate total expenses before every purchase.

The Bitget Card’s 1.7% comprehensive fee structure, without any top-up or monthly maintenance costs, makes it one of the cheapest no-KYC crypto credit cards in 2025. For frequent spenders who want to avoid compounding costs from recurring charges, Bitget is especially attractive (Bitget Wallet source). Users praise its simplicity: every transaction includes all associated costs upfront.

If you’re seeking true decentralization and self-custody, both the Cypher Card and Solayer Non-Custodial Card offer minimal transaction or network-only fees, with absolutely no KYC process at any stage. These options are ideal for privacy maximalists who want to avoid centralized risk entirely while keeping ongoing costs low. Cypher’s non-custodial approach means you hold your private keys at all times.

A Closer Look at Wirex, Paycent and Solayer: Niche Advantages in Fee Structure

The Wirex Anonymous Crypto Card’s lack of monthly or annual fees combined with regionally competitive FX rates makes it appealing for cross-border purchases, especially if you need flexibility without committing to high balances.

The Paycent Crypto Debit Card offers no KYC requirements for lower spending tiers and maintains competitive per-transaction pricing, perfect if your needs are occasional rather than intensive.

The Solayer Non-Custodial Card distinguishes itself by charging only transparent blockchain network/gas fees, with zero additional markup, which can be incredibly cost-effective during periods of low blockchain congestion.

For users who prioritize anonymity, the choice between these cards often hinges on fee predictability versus absolute control. The Bybit and Bitget cards lead for those who want a familiar, card-like experience with clear, upfront costs. Bybit’s 0.5% FX fee is among the lowest for international shopping, while Bitget’s 1.7% comprehensive fee is unrivaled for straightforward domestic spending. Neither imposes annual or monthly fees, so you avoid the slow drain of recurring charges.

Non-custodial solutions like Cypher Card and Solayer Non-Custodial Card push privacy to the maximum by eliminating not only KYC but also most platform-imposed fees. Instead, you only pay blockchain network (gas) fees, variable but often negligible during off-peak periods. This structure appeals to crypto-native users who are comfortable with wallet management and want to minimize third-party risk. Cypher even allows you to retain full control of your private keys, a crucial advantage in today’s regulatory climate.

Wirex Anonymous Crypto Card strikes a balance: no monthly or annual fees and competitive FX rates make it suitable for travelers or remote workers who need flexibility across borders. For those with modest needs, Paycent Crypto Debit Card’s no-KYC-for-low-limits model ensures access without exposing identity, while keeping per-transaction fees reasonable.

Which No-KYC Crypto Card Is Cheapest in 2025?

The answer depends on your spending habits:

- If you transact frequently and want simple cost structures: Bitget Card’s 1.7% comprehensive fee is hard to beat, especially for everyday use where hidden top-up or maintenance fees can erode value over time.

- If international purchases dominate your budget: Bybit Card’s lack of annual fees and low 0.5% FX charge stands out as the most predictable option (Bitget Wallet source).

- If privacy is paramount and you’re comfortable with crypto wallets: Cypher Card and Solayer Non-Custodial Card offer unrivaled anonymity with minimal or network-only fees.

- If you’re a light spender wanting to avoid KYC entirely: Paycent’s basic tier provides access without paperwork or high costs.

Final Thoughts: How to Choose Your No-KYC Crypto Credit Card

The landscape of no-KYC crypto card fees in 2025 is more competitive than ever before. While every card on this list delivers privacy by design, their fee models cater to different user profiles, from frequent shoppers seeking predictability (Bybit, Bitget) to hardcore privacy advocates embracing non-custodial tech (Cypher, Solayer). Wirex and Paycent round out the field by serving niche needs like cross-border spending and low-limit access without KYC hassle.

Avoiding hidden costs starts with understanding your own transaction patterns, and matching them to a card that minimizes friction at every turn. As always in crypto finance: read the fine print, monitor network conditions if using non-custodial cards, and stay informed as new options emerge.

Pros & Cons: Top No-KYC Crypto Credit Cards (2025)

-

Bybit CardPros: No annual fee, no hidden charges, and only a 0.5% foreign exchange fee on top of Mastercard’s rate. Widely accepted and easy to manage.Cons: Requires identity verification for higher limits; not fully non-KYC for all features.

-

Bitget CardPros: Industry-low 1.7% comprehensive fee, with zero top-up or monthly maintenance charges. Supports multiple cryptocurrencies.Cons: May have limited availability by region; not all features are fully non-KYC for high-value usage.

-

Cypher CardPros: Non-custodial, minimal transaction fees, and no KYC required. Enhanced privacy and user control over funds.Cons: Limited customer support and fewer integrations with mainstream payment systems like Apple Pay or Google Pay.

-

Wirex Anonymous Crypto CardPros: No monthly or annual fees, low foreign exchange rates, and supports a wide range of cryptocurrencies.Cons: Some features may require basic verification; not all card tiers are fully anonymous or non-KYC.

-

Paycent Crypto Debit CardPros: No KYC for low spending limits, competitive transaction fees, and supports multiple digital assets.Cons: Spending and withdrawal limits are lower for non-KYC users; higher limits require verification.

-

Solayer Non-Custodial CardPros: No KYC required, transparent network fees only, and non-custodial design for enhanced privacy.Cons: May have limited merchant acceptance and fewer fiat currency options compared to custodial cards.

The best no-KYC crypto credit card isn’t just about the lowest headline fee; it’s about aligning functionality with your unique priorities, be it travel, daily use, or uncompromising privacy.