Privacy-focused crypto users are increasingly seeking ways to spend digital assets online without sacrificing anonymity. The rise of anonymous virtual crypto cards has made it possible to shop, pay for subscriptions, and manage daily expenses using crypto, all while avoiding intrusive identity verification (KYC) checks. In 2025, a handful of no-KYC virtual crypto credit cards stand out for their robust privacy features, ease of use, and global acceptance.

The Case for Anonymous Virtual Crypto Cards

With traditional financial institutions tightening surveillance and KYC regulations expanding worldwide, the demand for no-KYC virtual crypto credit cards has never been higher. These cards allow users to convert cryptocurrencies like Bitcoin and USDT into spendable fiat instantly, without linking their real-world identity. For those living under restrictive regimes or simply valuing financial privacy, these tools are essential.

The best options on the market deliver instant activation, support for multiple cryptos, low fees, and compatibility with major payment networks such as Visa and Mastercard. Below is a curated list of the top five anonymous virtual crypto card providers in 2025.

Top 5 Anonymous Virtual Crypto Credit Cards (No KYC)

-

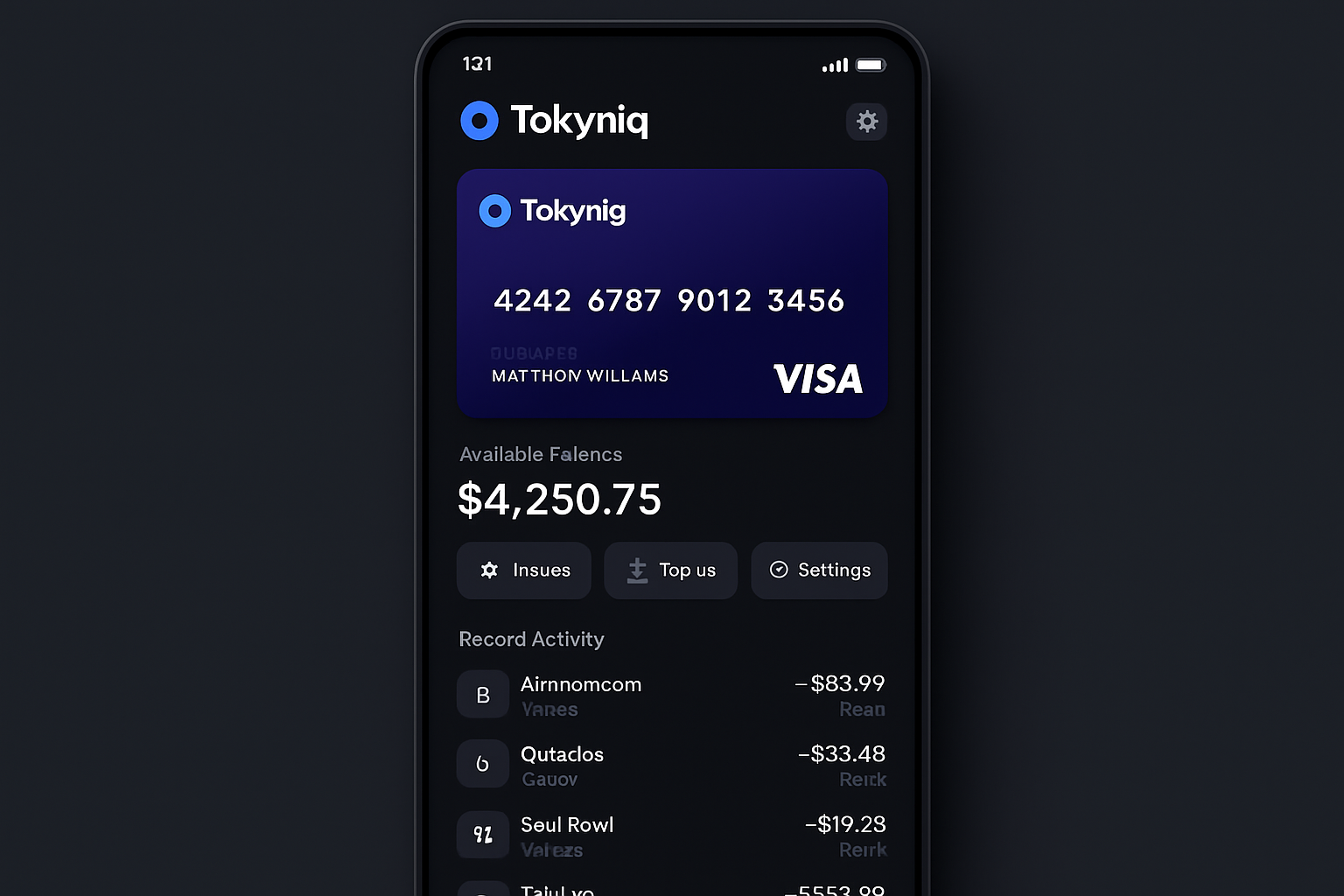

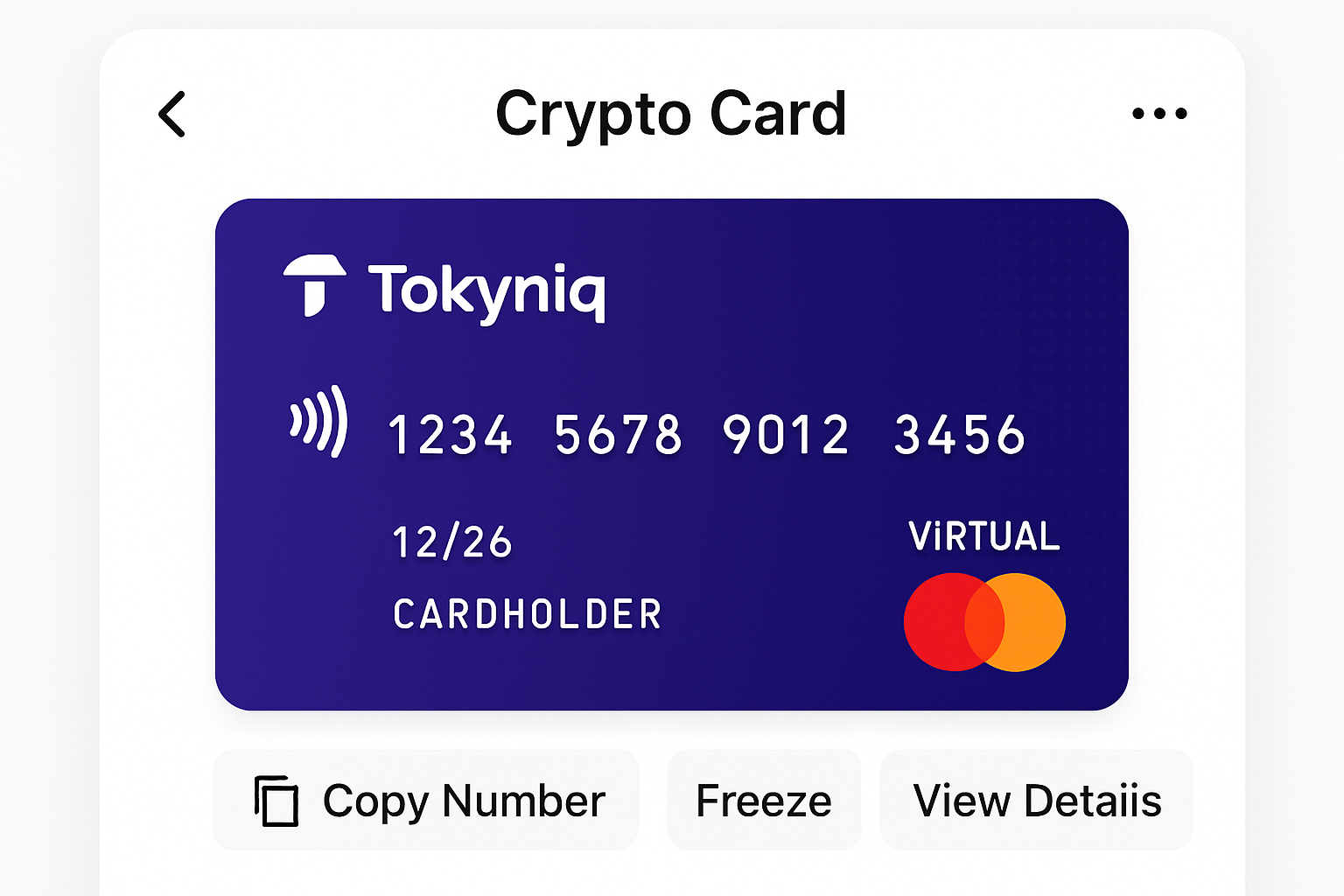

Tokyniq Virtual Crypto Card: Renowned for its no-KYC requirement, Tokyniq enables users to instantly generate virtual cards funded by BTC, ETH, or USDT. The platform is praised for low fees, fast issuance, and strong privacy—no identity documents are needed. Usable worldwide wherever Visa/Mastercard is accepted.

-

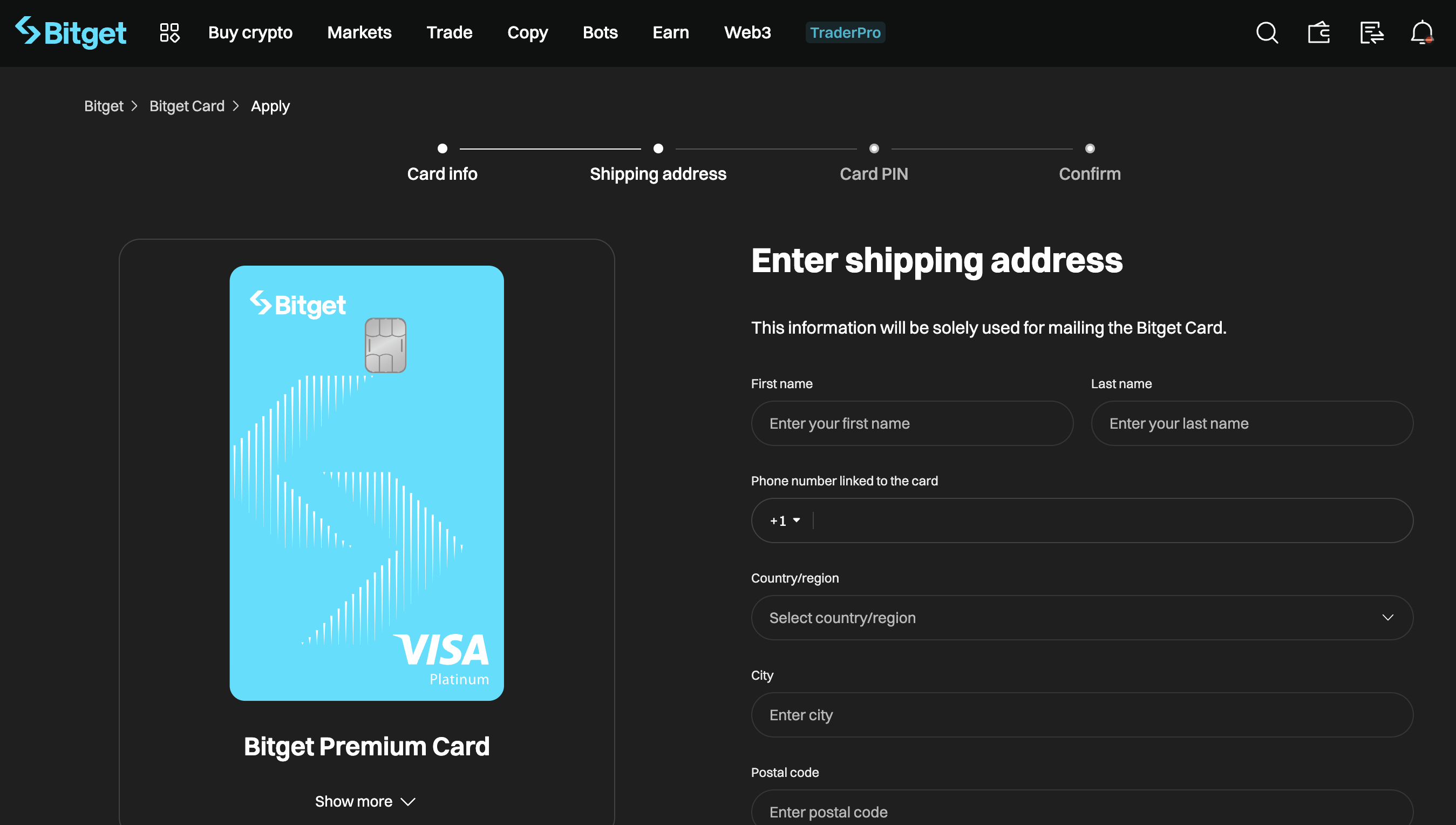

Bitget Wallet Card: Bitget’s virtual card offers anonymous spending with no KYC needed for basic usage. It supports multiple cryptocurrencies and allows seamless online payments. Key privacy features include minimal data collection and instant card issuance for verified wallet users.

-

CoinsPaid Virtual Card: This card provides privacy-first virtual payments with no mandatory KYC for low-volume users. It supports a wide range of cryptocurrencies and offers real-time crypto-to-fiat conversion for online purchases, making it a convenient and private option for everyday use.

-

Advcash Crypto Card (Virtual Option): Advcash’s virtual crypto card is known for its flexible account setup and optional KYC for limited usage. Users can fund the card with multiple cryptos and enjoy fast online payments without sharing extensive personal data, making it suitable for privacy-conscious users.

-

SpectroCoin Virtual Prepaid Card: SpectroCoin offers a virtual prepaid card that can be topped up with various cryptocurrencies. For lower limits, KYC is not always required, enabling anonymous online spending. The card is accepted globally and features instant issuance for verified wallet holders.

Tokyniq Virtual Crypto Card: Maximum Anonymity at Low Cost

Tokyniq has earned a reputation on forums like r/Bitcoin for delivering one of the most private experiences in the segment. The Tokyniq Virtual Crypto Card requires no KYC or documentation, sign-up is as simple as an email address. Users fund their card with BTC or USDT and receive an instantly issued Visa-compatible virtual card. With low fees and a transparent pricing structure, Tokyniq is ideal for those who need quick setup and maximum discretion.

User feedback consistently highlights its reliability for online shopping and recurring payments while keeping personal data shielded from third parties.

Bitget Wallet Card: Web3 Native Privacy Spending

The Bitget Wallet Card positions itself as a gateway to anonymous spending in the Web3 era. No ID verification is needed to apply, users can load their card directly from Bitget’s non-custodial wallet interface using BTC, ETH, USDT, or other supported coins. This makes it especially attractive to DeFi users who want seamless integration between self-custody wallets and real-world spending without exposing their identity.

The Bitget Wallet Card supports major online merchants worldwide and offers competitive fees on both issuance and usage. Its user experience is streamlined for quick onboarding, making it one of the most accessible options for those prioritizing privacy in everyday transactions.

CoinsPaid Virtual Card: Versatile Funding With True No-KYC Access

CoinsPaid, long known as a trusted payment processor in the crypto industry, now offers an anonymous virtual card option that lives up to its brand’s reputation. The CoinsPaid Virtual Card can be funded with a wide range of cryptocurrencies, including BTC, ETH, USDT, and does not require any KYC checks for basic usage tiers.

This flexibility allows users to remain pseudonymous while accessing mainstream e-commerce platforms globally. The platform is noted for its fast issuance process (often within minutes) and its responsive customer support team dedicated to privacy-first clients.

For privacy seekers, the CoinsPaid Virtual Card stands out for its blend of usability and discretion. Its ability to accept a broad variety of cryptocurrencies without demanding intrusive personal details makes it a top pick for those who value both flexibility and anonymity. The card’s virtual format is ideal for online shopping, digital subscriptions, and even recurring payments, without ever linking back to your real-world identity.

Advcash Crypto Card (Virtual Option): Global Reach With Minimal Data Exposure

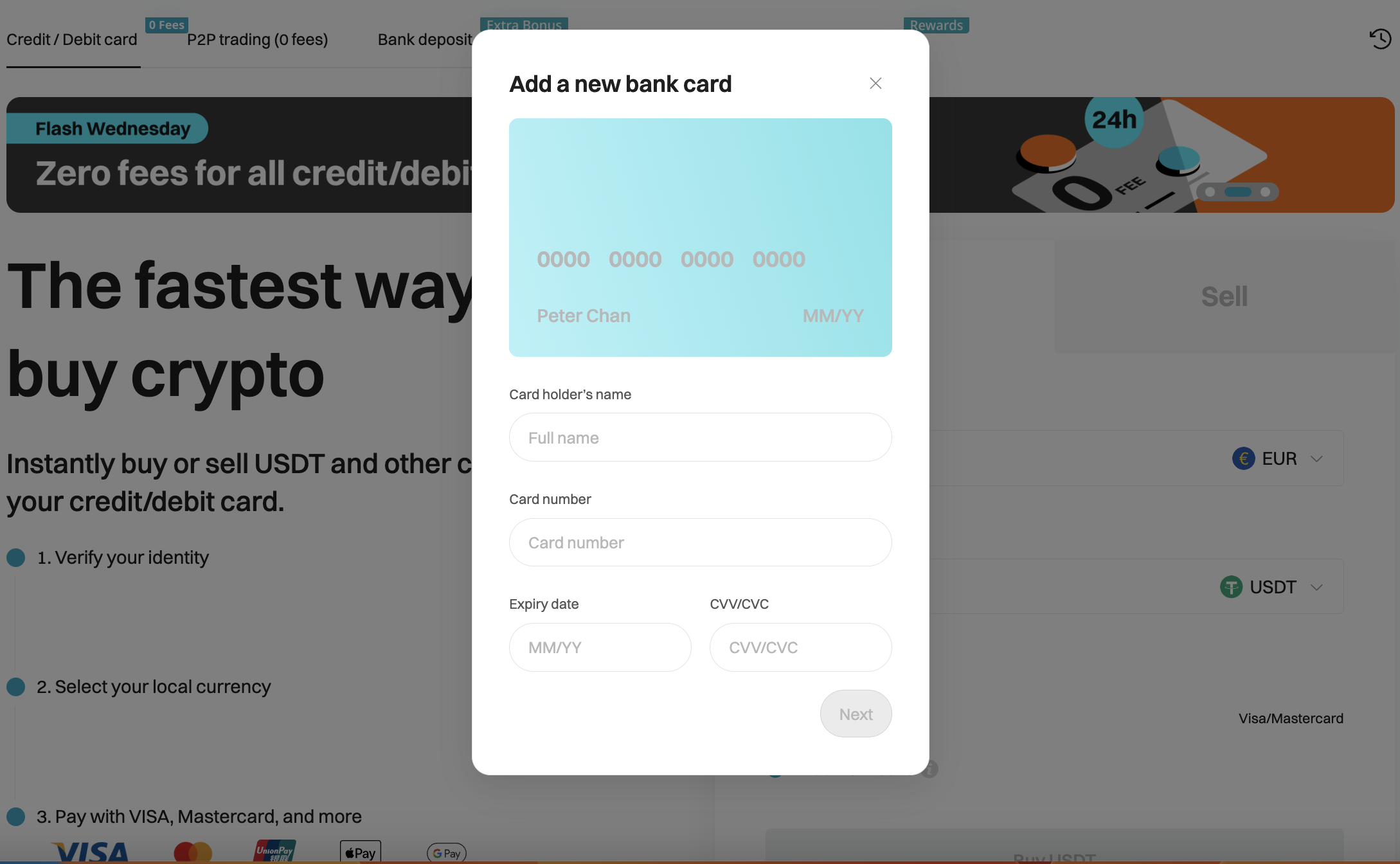

The Advcash Crypto Card (Virtual Option) has been a mainstay in the privacy crypto card market due to its minimal data requirements and global usability. While Advcash offers both physical and virtual cards, privacy-focused users consistently choose the virtual option for instant issuance and ease of use. You can fund the card with Bitcoin, Ethereum, USDT, and other major coins directly from your Advcash wallet.

The platform is recognized for its straightforward onboarding process, no complex verification steps or document uploads are needed at entry-level tiers. This makes it possible to make purchases on international websites or pay for services while keeping your identity protected from third parties. Advcash’s transparent fee structure and responsive support further cement its place as a go-to option for anonymous spending.

SpectroCoin Virtual Prepaid Card: Instant Use With Broad Merchant Acceptance

SpectroCoin rounds out the top five with its Virtual Prepaid Card, which is tailored for users who need immediate access to their crypto funds online. The sign-up process is streamlined, requiring only essential information at lower usage tiers, no full KYC required unless you exceed higher spending limits.

SpectroCoin’s card supports funding from BTC, ETH, USDT, and several altcoins. Once funded, you receive instant card details ready for use at any merchant that accepts Visa or Mastercard online. This makes it practical for digital nomads or anyone needing fast access to anonymous payment solutions across borders.

Top 5 Anonymous Virtual Crypto Credit Cards (No KYC)

-

Tokyniq Virtual Crypto Card: Renowned for its no-KYC policy, Tokyniq offers a virtual crypto card that prioritizes user privacy. The card is available instantly, can be funded with major cryptocurrencies like BTC, ETH, and USDT, and is accepted at merchants worldwide. Low fees and strong privacy controls make it a leading choice for anonymity seekers.

-

Bitget Wallet Card: Bitget’s virtual card enables users to spend their crypto without identity verification. It supports a wide range of cryptocurrencies, features instant issuance, and integrates with mobile wallets for contactless payments. Bitget is recognized for its user-friendly experience and robust privacy features.

-

CoinsPaid Virtual Card: CoinsPaid offers a privacy-focused virtual card that can be funded with various cryptocurrencies. With minimal KYC requirements and instant activation, users can enjoy fast, anonymous spending online. The platform is well-regarded for its security and transparent fee structure.

-

Advcash Crypto Card (Virtual Option): Advcash provides a virtual crypto card option with a streamlined sign-up process and limited verification. It supports multiple cryptocurrencies, offers instant card issuance, and is accepted globally. Advcash is popular for its balance of privacy and convenience.

-

SpectroCoin Virtual Prepaid Card: SpectroCoin’s virtual prepaid card is designed for privacy-conscious users, requiring minimal personal information. It supports funding with major cryptocurrencies and can be used for online purchases worldwide. The card is known for its ease of use and strong privacy protections.

What to Consider When Choosing an Anonymous Virtual Crypto Credit Card

When selecting an anonymous virtual crypto card, consider these critical factors:

- Supported Cryptocurrencies: Ensure your preferred coins (BTC, ETH, USDT) are accepted.

- Fee Structure: Look for transparent pricing on activation ($2.50–$6 per card) and usage.

- KYC Thresholds: Some cards allow higher spend before triggering ID checks; others remain no-KYC regardless of volume.

- Merchant Acceptance: Opt for cards compatible with major networks like Visa/Mastercard for global reach.

- User Experience: Instant issuance and mobile wallet integration (Apple Pay/Google Pay) offer added convenience.

The above five options consistently rank among the most reliable in terms of privacy guarantees and simplicity. Each strikes a balance between regulatory compliance (where necessary) and user protection through minimal data collection policies.

The Ongoing Evolution of Privacy in Crypto Payments

The landscape of no-KYC crypto credit cards continues to evolve as demand grows among users unwilling to trade privacy for convenience. Platforms like Tokyniq and Bitget Wallet have demonstrated that secure spending doesn’t have to come at the cost of personal freedom. Meanwhile, established providers such as CoinsPaid, Advcash, and SpectroCoin are adapting by offering robust virtual solutions that meet modern expectations around speed and discretion.

No matter which provider you choose from this list, always review current fee schedules and supported assets directly via their official sites before funding a new card. As regulations shift globally, staying informed will help maintain both your financial autonomy and peace of mind when transacting online.